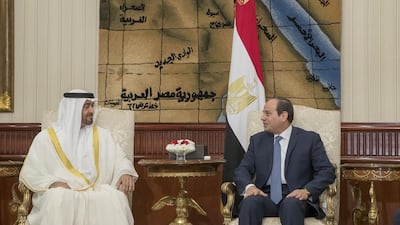

CAIRO // Sheikh Mohammed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces, met with the Egyptian president on Monday in Cairo where the two men discussed the fight against terrorism, especially its funding and those who provide it with media cover, in an apparent criticism of Qatar.

The UAE, Saudi Arabia, Bahrain, and Egypt cut diplomatic and commercial ties with Qatar two weeks ago, accusing it of supporting terrorism, meddling in their affairs and cosying up to Iran.

“Both sides stressed the importance of all Arab states and the international community fighting terrorism, especially stopping the funding of terrorist groups and providing political and media cover,” said the office of the Egyptian president, Abdel Fattah El Sisi, without referring to Qatar explicitly.

Sheikh Mohammed, meanwhile, said the UAE was keen on strengthening cooperation with Egypt and other Arab brethren to bolster regional stability and confront suspicious agenda designed to create chaos in the region, according to UAE state news agency Wam.

The meeting came hours after Qatari foreign minister Sheikh Mohammed bin Abdulrahman Al Thani said Doha had not received any demands from its Gulf neighbours and that Qatar’s internal affairs are non-negotiable, including the future of Doha-based television news channel Al Jazeera.

The UAE recently blocked Al Jazeera while the channel has been banned in Egypt since 2013.

* Reuters