Iraq’s new prime minister made a significant gesture towards the country’s protest movement on Sunday as the country’s judiciary ordered courts to release all protesters held in prison.

In a briefing on Saturday, he vowed to ensure their release, except those involved in violence, and announced the opening of an investigation into anti-government rallies that have descended into violence since October so the families of those killed while protesting can be compensated.

The Supreme Judiciary Council said in a statement that it had ordered the release of protesters detained since those demonstrations erupted, in line with the new prime minister's call.

The council released detainees based on Article 38 of the constitution which guarantees the right to protest, "provided that it is not accompanied by an act contrary to the law," the statement said.

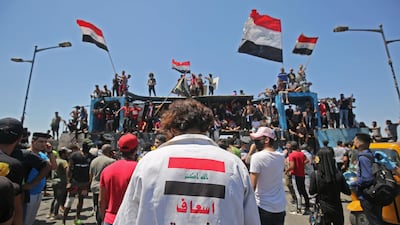

Mr Al Kadhimi’s cabinet met in Baghdad to agree new policies to acquiesce protesters that rallied again on Sunday in Baghdad’s Tahrir Square despite the coronavirus outbreak.

“We directed the security services to release all detained protesters,” he said in a televised statement.

“The Cabinet also decided to establish a high-level fact-finding committee to investigate what happened in Iraq since October 1 in order to provide accountability and to compensate the families of the martyrs.”

Protests erupted in Baghdad and across the country's south on October 1, when frustrated Iraqis took to the streets to decry rampant government corruption, unemployment and poor services. Human rights groups say at least 600 people died in the following three months at the hands of Iraqi security forces who used live fire and tear gas to disperse the crowds.

He also announced that the federal government would release pension payments, as well as establish a panel of experts that would examine how the country could hold free and fair elections, a key demand of the protest movement.

The new premier also reinstated and promoted General Abdulwahab Al Saadi, a popular military figure whose abrupt dismissal by previous premier Adel Abdul Mahdi in September had been a main catalyst of the first protests.

Gen Al Saadi is now head of Iraq’s elite Counter-Terrorism Service, just as the country was experiencing an uptick in attacks by ISIS in the north. Previously, the general was a force commander in the service before Mr Abdul Mahdi demoted him in September to a post in the Defence Ministry. The Iraqi public considered his sudden demotion a sign of corrupt government practices and took to the streets in outrage.

Gen Al Saadi, 56, was one of the leading commanders in the fight against ISIS and the battle to retake Mosul, taking the lead in many operations.

In a recent briefing with reporters, American Lt Gen Pat White, head of the Combined Joint Task Force responsible for fighting ISIS, said the group was failing “miserably” in a renewed campaign to launch more attacks.

People are calling for an end to corruption, unemployment, mismanagement and a lack of public services in a country that earns billions of dollars every month from oil.

But internal splits, a rise in US-Iran tensions and a lockdown imposed by coronavirus effectively snuffed out the movement earlier this year, leaving a few protesters camped out in squares across the country.

Last week, after Iraq's parliament approved a new cabinet headed by Mr Al Kadhimi, campaigners promptly issued calls on social media for more protests, saying the new prime minister was part of the same reviled political class.

Protesters turned out overnight in the city of Kut, setting fire to the

headquarters of the Iran-backed Badr Organisation and to the home of an MP affiliated with another Tehran-aligned faction, according to AFP.

Hundreds more hit the streets on Sunday morning.

And Mr Al Kadhimi called on parliament to adopt the new electoral law needed for early polls as demanded by the protesters.

Still, demonstrators remained sceptical.

"We will give him 10 days to prove himself, and if our demands aren't met, then we will escalate," said Mohammad, a student protester returning to Tahrir on Sunday.

"Today is a message."