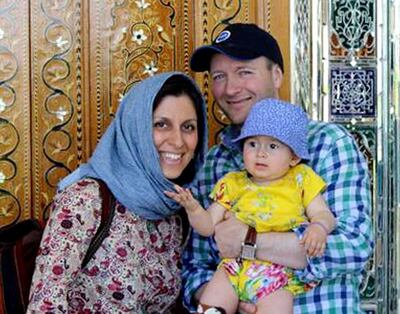

The husband of Nazanin Zaghari-Ratcliffe called her five-year detention in an Iranian jail a “blot on British diplomacy”.

Richard Ratcliffe was speaking before March 7, the release date Iran initially set for his wife.

He said the couple's daughter, Gabriella, was counting the days until her mother's scheduled release.

But Gabriella, 6, has been let down before, he said.

“It is a blot on British diplomacy and clearly Iranian hostage-taking is outrageous,” he said.

When UK Prime Minister Boris Johnson was serving as the country's foreign secretary, he wrongly told MPs that Ms Zaghari-Ratcliffe might have been in Iran to train journalists.

Iranian state media used his comments to justify her detention on charges of espionage.

Mr Johnson apologised and said he would leave no stone unturned in trying to secure her release.

“If she doesn’t come home, I want to know what you’re going to do on March 8. There’s no ambiguity, that’s proper straightforward hostage-taking,” Mr Ratcliffe said.

“Do I have confidence that the government is going to get her home on March 7? No, I’m standing here worried.”

Ms Zaghari-Ratcliffe was stopped at Tehran’s international airport as she was preparing to return to London after visiting her parents with her daughter in April 2016.

She was accused of plotting to topple the Iranian government but her trial was held in secret and the case against her has never been made public.

“It is shocking that what started off as a mum and a baby on holiday could be allowed to last for five years,” Mr Ratcliffe said.

He said Gabriella had a calendar “that she crosses off each day”.

“She’s counting down and I think probably still treating it like an advent calendar, so the days will come off and then the magic delivery will happen," he said.

“In terms of her wider understanding, for a long time she’s been asking: ‘When’s mummy coming back?’

“Hopefully this won’t be tough for her psychologically if mummy doesn’t come back at the end of all those days on the calendar. She’s had a lot of experience of grown-ups promising her that mummy’s coming home and then mummy not coming home.”

In December, Gabriella wrote a Christmas card to Mr Johnson pleading for help.

“Dear Boris Johnson, please can you bring my mummy home for Christmas,” she wrote.