India’s Supreme Court says the Gujarat government is on "thin ice" for granting remission, or early release, to 11 men convicted of gang raping a Muslim woman and killing her family during sectarian riots in 2002.

Bilkis Bano was sexually attacked and 14 of her family members were killed by a Hindu mob in western Gujarat state in March 2002.

The top court is hearing a batch of petitions against the decision by the Gujarat government to grant remission to the 11 convicts by India’s Hindu nationalist Bharatiya Janata Party government on Independence Day last year, after one of them pleaded for early release after 15 years in prison.

The men were serving life sentences for mass murder and violent sexual assault during communal riots in Gujarat.

A two-bench judge on Thursday asked the state government to explain the reasons for the early release of the convicted men.

"The convicts' death penalty was commuted to life imprisonment. How could they be released after serving 14 years in such a situation? Why are other prisoners not given the relief of release? Why were these culprits selectively given the benefit of the policy in this case?" Justice BV Nagarathna asked the Gujarat government.

The top court has further asked the government to provide them with data on granting remission to other prisoners.

"How far is this rule – giving a chance to hardened criminals to reform by releasing them after 14 years – being applied to other prisoners? Why is the policy being applied selectively? Opportunity to reform and reintegrate should be given to all. How far is this being implemented? Why are our prisons overflowing? Give us data," the court said.

Ms Bano was 21 and five months pregnant when the men raped her and several female family members before killing 14 of them when they tried to flee marauding Hindu mobs.

The attackers had presumed her to be dead after the assault, but Ms Bano and two other children survived the attack. Seven bodies were never found.

The dead included her mother, pregnant sister-in-law, a day-old niece and her toddler daughter Saleha, who was bludgeoned to death with a rock.

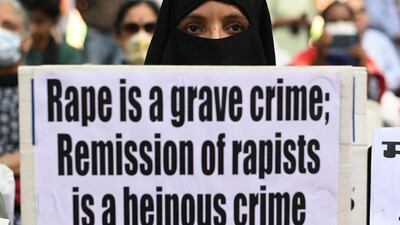

Viral images and videos showed the convicts being celebrated with sweets and garlands by relatives and extremist Hindu groups coincided with India’s Independence Day celebrations. The scenes triggered national and international outrage amid demands for their release be revoked.

The legal plea has been filed by Suhashini Ali, a communist politician, journalist Revati Laul and Prof Roop Rekha Verma.

A separate public interest litigation was also filed by opposition parliamentarian Mahua Moitra against the releases, arguing that the move has caused “legitimate apprehensions regarding the safety of her and her family members”.