The Philippines will elect a new president on Monday, May 9, and voting will also be held for thousands of other positions.

President Rodrigo Duterte is unable to stand for re-election under the country’s rules, which limit presidents to a single six-year term.

More than 67 million Filipinos are eligible to vote, including about 1.7 million who live overseas, in the Middle East and elsewhere.

As polling day begins, here is all you need to know.

When are the Philippines elections?

Polling stations will be open from 6am to 7pm local time on Monday, May 9.

Voting for registered overseas Filipinos opened on April 10.

When will we know the result?

Vote counting starts immediately after polls close.

A live, unofficial count could give an indication of who has won the presidency within hours, Reuters said.

The election commission is aiming to announce the complete results by the end of May.

The winner must be inaugurated as president within seven weeks of results being announced.

Who is the favourite to become the next president?

Ferdinand Marcos Jr, also known as “Bongbong”, is currently leading the race.

Polls indicate Mr Marcos Jr is on track to secure an absolute majority with more than half the vote.

He is the son of former president Ferdinand Marcos, who ruled from 1965 to 1986. Marcos Sr ruled under martial law from 1972 to 1981 and was widely considered a dictator.

On Monday, Mr Marcos Jr cast his vote with his mother, Imelda Marcos, who became notorious during and after the Marcos era for misusing billions of dollars' worth of public funds.

She was convicted by a court in the Philippines in 1993 and spent some time in exile in Hawaii with her family. In 1990, the Supreme Court of Switzerland ruled that funds deposited in Swiss bank accounts by Ms Marcos were of “criminal provenance.”

But this controversial history of the Marcos clan has not tarnished Mr Marcos Jr's campaign.

He is running on a platform of “unity” and has promised more jobs and greater security, though rights groups have voiced fears he could rule “without constraint”.

He is also allied to Sara Duterte-Carpio, the daughter of the departing president. She is running for vice president.

Who are Marcos Jr’s closest rivals?

Mr Marcos Jr’s closest challenger in the polls is Leni Robredo, the departing vice president.

Ms Robredo, who defeated Mr Marcos Jr in the 2016 vice presidential race, has been a fierce critic of both him and Mr Duterte.

Her campaign has promised transparency and economic reforms, and has been characterised by huge rallies of supporters dressed in pink, the chosen colour of her “pink revolution”.

Recent polling put her 33 percentage points behind Mr Marcos Jr.

Other challengers include the Manila Mayor Isko Moreno Domagoso, and the international boxing star Manny Pacquiao, though both are trailing Mr Marcos Jr and Ms Robredo in the polls.

Who are the other candidates?

While ten candidates filed to compete for president, the race has come down to a few main contenders — high profile figures such as Manny Pacquiao, a former boxer, are unlikely to make significant headway, while another prominent figure, Senator Ping Lacson — who has made several runs for the president role in the past, are trailing far behind.

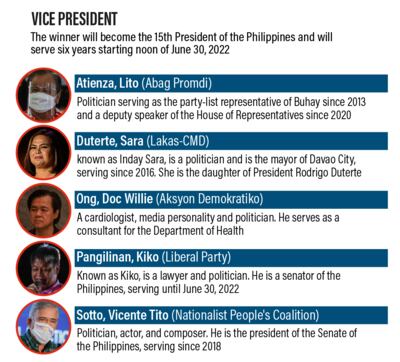

Who is running for vice president?

Unlike in the US, the Philippines elects vice presidents separately, though the vote is held on the same day.

Sara Duterte-Caprio is the current front-runner for the vice presidency. She is the daughter of the departing president and allied with Mr Marcos Jr.

Her main challengers are Senate President Vicente Sotto III and Leni Robredo’s running mate, Senator Francis Pangilinan.

According to the country's 1987 constitution, the vice president is “mandated to assume the presidency in case of the death, disability, or resignation of the incumbent president," although the vice president can also take the role of a cabinet minister.

Are political parties important?

Political parties are generally considered less important than personal loyalties in the Philippines.

Most candidates gain their support from personal appeal rather than a party base, and it is common for members of parliament to ally with whoever becomes president.

Can Filipinos overseas vote and how significant is their vote?

The Philippines has a large diaspora population across the world. There were 2.5 million Filipinos registered as living abroad in 2019, figures compiled by the Commission on Filipinos Overseas show.

These Filipino citizens are eligible to vote from their host countries.

About 1.7 million overseas Filipinos are registered to vote in 2022 out of the country's 67 million voters.

The country with the most registered voters is the UAE, with 290,182, followed by Saudi Arabia and the US.

More women than men are registered to vote overseas.

With inputs from Pulse Asia.