DUBAI // A money exchange at the centre of a row over non-payment of workers' wages has also failed to transfer expatriate remittances.

Asia Exchange has now been reported to Dubai Police, employers who have lost money have gone to court and individuals with unpaid remittances are investigating what legal action they can take.

The row began more than a month ago when companies transferred hundreds of thousands of dirhams to Asia Exchange in employee salaries, which it failed to pay out.

Yesterday an expatriate couple in Abu Dhabi who used the agency to send Dh40,000 to their account in India on May 27 said there was no sign of their money.

"We were told it would be in our account by July 3," said the husband, an engineer. "But as of now we still haven't had the money go through."

Call after call has been placed to the agency's branch in Mussaffah, but they are always told the money "will be sent in two or three days".

"Our parents and children are in India and we have a house there, which is why we have to send the money back.

"We have told them that we will accept the transfer at a lower exchange rate or if they return the money to us in instalments. But we haven't had any response."

The couple are investigating what legal action they can take against the agency if they do not receive their money soon, and have also contacted the Indian Embassy for help.

More than a dozen companies also want an explanation from Asia Exchange for what has happened to their workers' wages. The agency said initially the problem was a computer glitch, but the money still has not been paid and companies are now resorting to legal action.

Under the Ministry of Labour's Wages Protection System, employee salaries cannot be paid in cash and must be paid through a bank or an exchange bureau.

This allows the ministry to keep tabs on transactions and ensure workers are paid on time without any unlawful deductions.

Chirag Contracting in Dubai transferred Dh339,000 to Asia Exchange in salaries for its 300 workers on August 11, but the wages were never paid.

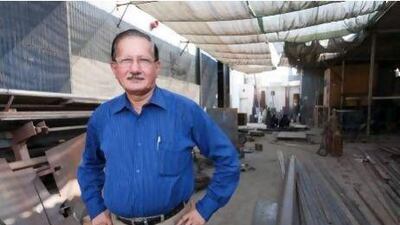

"We have so far received Dh70,000 back from the exchange," said Vinod Alora, group director of finance at Chirag. "We made a police complaint last week because the situation is ridiculous.

"We have been getting some money in dribs and drabs but have no idea when we will get the full amount back. The situation is crazy. We sent through the money more than four weeks ago and our workers are really suffering because of this."

He said the non-payment of August wages was compounded because the delay had come after a traditionally quiet period for the company.

"Many of our clients were away during the Ramadan and Eid period because of holidays, so this delay in salary payments has hit the workers hard."

Fortuna Engineering in Sharjah deposited Dh30,800 for its 28 workers at Asia Exchange on August 12.

They have also not received their money, said marketing manager Lavita D'Souza, and have filed a complaint against the centre in a Dubai court.

"It's been more than a month now and every time we contact them we get told it's a computer problem," she said.

"They keep telling us it will go through in a couple of days but then nothing happens."

She said the company felt compelled to pay their workers in cash after Eid, despite the law, because they did not want them to be out of pocket.

"We've filed a complaint against Asia Exchange in Dubai Court," said Ms D'Souza. "At the moment we have not been given a date for when it will be heard."

The company has also complained to the Central Bank in Abu Dhabi but have not yet had a response.

Asia Exchange and its parent company Ali Omran Al Owais did not respond to The National's multiple phone and email requests for comment.