Visitors to Expo 2020 Dubai are being offered a glimpse into a future where replacement limbs and tissue are routinely created on 3D printers in hospitals.

The Australian Pavilion is showcasing technology that has already been used on hundreds of patients who have lost limbs and experienced tissue loss due to cancer, trauma and congenital defects.

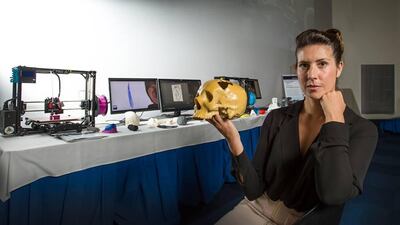

Guests are greeted by a video display of Australia’s latest innovations, during which Prof Mia Woodruff, from Queensland University of Technology, talks about the pioneering technology she believes could become a mainstay of hospitals around the world in years to come.

The professor was at the pavilion in person on Wednesday afternoon to explain why people should be excited about what the medical innovation means for the global health sector.

“Usually if you had broken your leg and had to go for treatment in hospital you would have had to have bone taken from your pelvis, for example, to help repair it and you would end up limping on both legs as you left the hospital,” she said.

“Now we can do an imaging scan of your leg and create a 3D model and then print out an implant that can go into your leg without needing to take tissue from any other part of your body.

“Effectively everyone can be treated a lot more rapidly and a lot more cheaply.”

She said the technology, known as biofabrication, means patients could have their conditions diagnosed long before they reach the hospital for treatment.

“If a patient has an accident on the side of the road, the emergency team could use a scanner to scan the missing tissue and send it ahead to the hospital,” said Professor Woodruff.

“The hospital can then go ahead and print the implant so it’s ready for when they arrive.”

The replacement tissue that is created consists of polymers that slowly break down over “many, many” years, the professor said.

She said there had been several success stories over the years in hospitals in Brisbane, in particular, with a patient’s leg being saved from amputation in one case in 2018, using the technology.

“Over the last 10 years, 3D printing has revolutionised almost every industry in the world,” said Prof Woodruff.

‘That’s especially the case with hospital healthcare because we’re able to print out materials that are compatible with the human body.

“Previously if you needed a hip replacement the doctor was only able to choose from small, medium or large sizes but now we are able to create more exact sized replacements that are personalised for patients.”

The technology also has the capacity to help hospitals worldwide to save money as they will be able set up manufacturing sites within their premises, she added.

She said, while the technology is still in its infancy, it has already been used to help patients suffering from a litany of conditions.

“There have been recent cases of entire sternums being replaced and people who have had rib injuries and have received polymer implants,” said Prof Woodruff.

“There have even been people who had 3D printed skull replacements and others who have needed their skull drilled, to release pressure on their brain, have had re-absorbable polymers used to plug that gap.”

One by-product of the technology is the new job opportunities it will create in the hospital industry, she added.

“We’re creating jobs for people in hospitals who don’t need to be clinicians,” she said.

“There will need to be people working in the hospitals who are able to code and run 3D printers.

“3D printing technicians will be vital members of the team in the hospitals of the future.”

The technology also represents the opportunity for hospitals to vastly reduce costs, with more precise diagnoses meaning patient care can become more efficient, the professor added.

“Most people have been affected by a cancer excision or traumatic accident, or know someone who's had a birth defect,” she said.

“They can all understand what it's like to be faced with excessive hospital visits, or expensive imaging or bills to pay for it.

“So what we're trying to show with the hospital of the future is that technology is going to make that more accessible, treatments will be better, faster, and cheaper.”