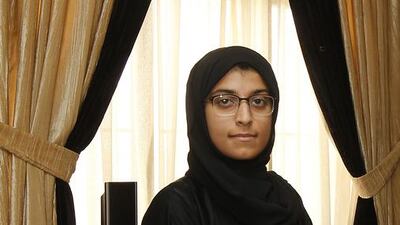

ABU DHABI // When Heyam Al Blooshi heard about the UAE’s plan to send an unmanned probe to Mars in 2021, she felt the need to take part.

The 26-year-old had been working as a planning engineer for Gasco (Abu Dhabi Gas Industries) in Al Ruwais, in the Western Region, for the past two years.

But that did not diminish her love for space science. So, when the Mohammed bin Rashid Space Centre announced that it would send students to American universities this summer as part of the Hope mission, she immediately wanted to apply.

“I am interested in building the satellite for the UAE’s Mars mission, piece by piece, and programming the software that they are going to use,” said the Emirati from Abu Dhabi. “I want to work on how they are going to protect it from the Sun, what technology they are going to use.

“There are so many questions, such as how can we utilise that wasted heat and energy within the satellite itself?”

In the programme, students will undergo intensive training in space sciences at the University of California, Berkeley, and the University of Colorado, Boulder.

Her aim was to make the mission “smarter and one step ahead. It may sound silly but it will give it that special Emirati touch,” she said.

After graduating as a mechanical engineer from the Petroleum Institute in 2011, she was granted an elite fellowship at the Nasa Ames Research Centre in California.

“I stayed there for five months then came back to the UAE, where I started working at Gasco,” she said.

“The experience was outstanding. It was very well rounded and beneficial and the amount of research and technology they use is very interesting because it is very high-tech, including elements that the UAE could use.”

Some of the technology she dealt with related to recycling water for astronauts.

“It’s very expensive to ship water to space so their technology purifies human liquid waste into water,” she said.

“My project was related to that and I worked with a mentor there on bio-engineering. I was very interested in it.”

Next she applied for Cornell University, in New York state, where she got accepted on a full scholarship to study biomedical engineering.

“I had to decline because my father wanted me to work in the UAE,” she said. “He didn’t really grasp the idea of sending me abroad, especially to the US.

“It was devastating, to be honest, but everything happens for a reason and my aim is to break the stereotype for ladies in the UAE and be a role model for young Emiratis and the next generation.

“I was born in Bani Yas and attended a government school where everything was in Arabic. I then went to one of the toughest universities and graduated as an honours student but never gave up my image.”

Ms Al Blooshi’s next goal is to acquire a master’s degree in mechanical engineering, specifically in solid state mechanics, then follow this with a doctoral degree.

“My interest is in vibration and automation, which means how we benefit from energy wasted,” she said.

“For instance, when you drive over a hump, the shock absorbers move and we can store that movement into electricity using a device and use that energy to power lights in cars.

“I believe that little things matter the most – though all other engineers look to solve the problems of the world by looking at the bigger picture, not the details. But if you add all these details, you can benefit from them and gain a larger and more efficient system.”

cmalek@thenational.ae