ABU DHABI// Filmmaking experts are trying to encourage Emiratis to take up careers in the industry, saying that movies are critical to telling the story of the country.

Allan Nicholls has just finished his first term as art director at the New York Film Academy in Abu Dhabi. Previously, he was a director, screenwriter and actor in Hollywood, with roles in films such as Robert Altman’s Nashville and Tim Robbins’s Bob Roberts. He also wrote material for Altman’s The Player and Pret A Porter.

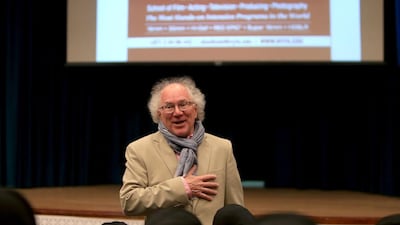

On Wednesday, he gave a speech to school pupils at the Abu Dhabi Vocational Education and Training Institute where he urged them to consider becoming filmmakers.

“When I first got here, I knew that there were so many stories to be told and nobody to be telling them, one doesn’t know the history of this place and part of the challenge is to encourage people to tell their stories, and through that a culture survives and lives on,” said Mr Nicholls.

Part of the problem, he says, is that there is a generational gap between those who think that movies are taboo and the new generation who recognise the importance of film.

“On one hand, I think no wonder they don’t want to encourage films, that there’s an insecurity about what might happen and that comes from what you see in commercial, western films.

“But more importantly there are some stories that should be told in the UAE, good stories, historical stories, and there’s this whole other generation who are making films with these real stories,” he said.

Last week, Mr Nicholls was part of a judging panel for submissions by 30 schools at the Children’s International Film Festival in Dubai.

“The guests of honour were the chief of police and the general of Dubai Police force and I spoke to both of them and they kept asking ‘what is it going to take to get some Emirati stories being told?’” he said.

“They see the frustration but they also see the possibility in the medium.”

During his presentation, Mr Nicholls used films, pictures and stories from his career to emphasise the importance of teaching film to future generations.

“You don’t really teach film, you encourage filmmakers,” he said.

“Filmmaking is something that you do, it’s when your head and your heart talk and tell a story. That conversation can take two days, 10 days, two years, 10 years, but in the end when you feel passionate about telling the story you will not make mistakes, because you are telling your story your way.”

More than 100 pupils from Secondary Technical Schools (STS) in Abu Dhabi, Al Ain and Ajman were present at the lecture.

The schools now run a year-long course in creative media production to teach all aspects of filmmaking.

Wafeer Ali, who is taking the course, is a fan of Studio Ghibli – the makers of Japanese anime blockbusters such as Princess Mononoke and Spirited Away – and says it is his dream to make similar animated films about the UAE.

“I was more interested in animation and computer games, I was just fixed on this idea but getting into this programme made me think that there are so many interesting aspects of filmmaking,” said the Emirati from Ajman.

“Mr Allan’s talk was really inspiring and to see someone who has lived through the filmmaking experience, it encourages me even more. I’ve already talked to my mum about pursuing film.”

Her classmate, Alya Mohammed, also enrolled on the programme and is optimistic that her generation will become expert movie makers.

“We have a lot of girls who are interested in filmmaking and animation, so I think that when we grow up, our media and film industry will be pretty popular and maybe in a few decades we can even compete with Hollywood,” she said.

nalwasmi@thenational.ae