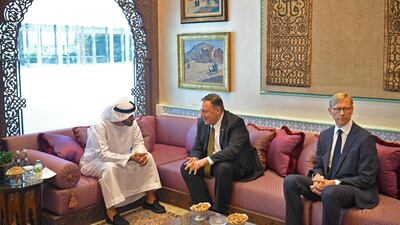

The UAE sets a good example for the rest of the Arab world, said former US secretary of state Mike Pompeo at the Mohamed bin Zayed Majlis on Tuesday.

Mr Pompeo said the UAE has continuously worked to foster peace and harmony in the Middle East and that is something others countries in the region can follow.

The UAE, US and Israel signed the Abraham Accords in 2020. The historic agreement helped to bring different cultures and religions closer together.

former US secretary of state

Mr Pompeo said he was highly impressed by the empowerment of women in the Emirates.

“Equality of men and women is the guiding principle of the UAE and enshrined in the American constitution,” he said.

“Your [Sheikh Mohamed’s] resolute actions towards ensuring that the women of your nation hold the same standards as men is a standard for the entire region – these actions have precipitated change far outside your borders.

“I saw statistics that said that 80 per cent of Emirati women are enrolled in higher education and many [are] specialising in Stem subjects – that is fantastic," he said.

According to a 2014 Economist Intelligence Unit survey, 85 per cent of the Emirati women that were polled studied Stem.

“I met a couple of Emirati engineers. I was once an engineer when I was a young man and they put my knowledge to shame," he said.

“Your nation’s first female fighter pilot led air strikes in her F-16 against ISIS. She supported your country and our efforts collectively to crush evil and extremists.”

Mr Pompeo said it was remarkable to see how American, UAE and Israeli soldiers trained together last week.

He said they were doing “God’s work in securing our people’s freedom together. This is real history brought about by our central shared understanding”.

Mr Pompeo, a devout Christian, said he believes that faith and family are irreplaceable, intertwined and crucial to making progress.

The US diplomat said we need to ask ourselves what kind of future we want for our children.

“Do we want barbarism that rules the world or decent people who want good things for every human being?” he said.

“Do we want reason and love to dominate the globe or do we want those who wish ill and seek only power and wealth for themselves?”

Mr Pompeo said honouring family ties is essential to ward off communist and totalistic regimes.

“We all have to make sure that we never put the state’s ambition between a parent and his children.

“This encroachment by government creates risks and must be fought so that the family must be honoured and never disrespected.

“The nature of the Arab family shines a light in a world where so many children do not know their parents or are away from them.

“I perceive the entirety of Middle East as God’s shelter for it was here that the three great Abrahamic faiths began and grew to illuminate the world."