We look at the performers making the news for the right - and wrong - reasons over the last weekend of English Premier League action.

Going Up

Aaron Lennon, Tottenham

Four straight league wins for the North London side and the English winger has been an integral part of that success. His strike, to seal the 2-0 win against Aston Villa, was his first in nine months and just reward for his penetrating runs and crosses from wide.

Wigan forwards Franco di Santo and Arouna Kone have each scored three goals so far, making them the most prolific pairing in the division. If Wigan Athletic are to secure their top-flight status for a seventh consecutive season, they will need the duo to keep up their healthy strike rate.

Jose Fonte, Southampton The Portuguese defender scored in the fourth minute and then netted a late equaliser in the 2-2 draw with Fulham. The point saw the South Coast side climb out of the bottom three for the first time this season.

Going Down

Jos Hooiveld, Southampton

This Saints defender did not have such a good game as his Portuguese counterpart. Hooiveld, who came on in the eighth minute after an injury to Frazer Richardson, scored an own goal, and just before full time Kieran Richardson’s shot deflected into the net off his boot.

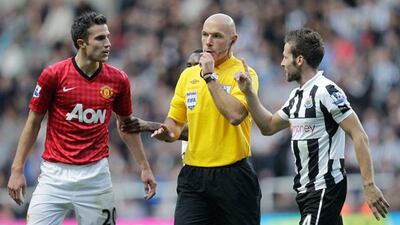

Violent conduct Manchester United's Robin van Persie, below, and Newcastle's Cheick Tiote escaped retrospective action for alleged violence. While Tony Pulis's call for Luis Suarez to be banned for diving seemed rich after Stoke's Robert Huth seemed to stamp on the Liverpool man's chest.

Ashley Cole, Chelsea The left-back was hit with an FA misconduct charge on after his foul-mouthed Twitter rant at the English game's governing body, after it questioned the evidence he gave in John Terry's racial abuse hearing.