Chelsea will decide this week whether to make a renewed bid for Luka Modric, Ron Gourlay, the Stamford Bridge chief executive, has revealed.

The west London club have had two offers rejected for the Tottenham Hotspur playmaker this summer, reportedly of £22 million (Dh132m) and £27m.

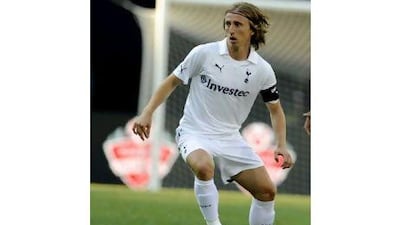

Spurs have repeatedly insisted Modric is not for sale but the Croatia international is said to have handed in a transfer request, accusing Daniel Levy, the Tottenham chairman, of reneging on a gentlemen's agreement to allow him to leave should a Champions League club bid for him.

Gourlay said he would now discuss with Andre Villas-Boas, the new Chelsea manager, whether the club should make a third bid for Modric or abandon their immediate plans to sign the 25 year old.

Speaking at the end of their pre-season tour of the Far East, which saw them lift the Asia Trophy in Hong Kong on Saturday, Gourlay told Sky Sports News: "I don't like talking about players from other clubs, but that's something we'll look at during the week and we'll take it from there.

"We really need to sit down with Andre and talk this through."

Big-money signings have been conspicuous by their absence at Chelsea so far this summer, with Villas-Boas keen to assess his current squad and avoid panic buys.

Last year's Premier League runners-up have won all of their pre-season games under the Portuguese without conceding a goal, gradually improving the level of their performances.

But there is little doubt they would benefit from greater subtlety in midfield, something that could be provided by Modric, who missed Tottenham's friendly at Brighton & Hove Albion on Saturday through illness.

As well as Modric, Chelsea have been heavily linked with the Palermo playmaker Javier Pastore - who is reportedly on the brink of joining Qatari-backed Paris Saint-Germain - and Romelu Lukaku, the Anderlecht striker.

Chelsea have signed the Belgian goalkeeper Thibaut Courtois, with the 19 year old immediately loaned out to Spanish side Atletico Madrid, while they have also had a bid accepted for the Barcelona midfielder, Oriol Romeu, to fill the void left by a serious knee injury to Michael Essien.

Villas-Boas has had less than a month to impart his ideas to his players but there are signs his messages are already getting through, chiefly that of encouraging them to take more responsibility on the field.

Daniel Sturridge, who spent the second half of last season on loan at Bolton Wanderers, was quoted in The Guardian newspaper as saying: "The manager has given me licence to express myself. I've never had that before with any manager. He's let me off the leash, if you like, and not just me: everyone feels like that."

Frank Lampard, the midfielder, said: "You all want to impress.

"He has been assessing the players, and, personally, I want to impress him now at the age of 33, just the same as I did with a new manager when I was 22. Simple as that. We are here to impress as individuals, and we want to make the group successful.

"There is a nice freshness about the team and the squad, and the players who maybe were not sure they were going to stay, or players that were on loan, or young players that have come through, are getting a sniff now."