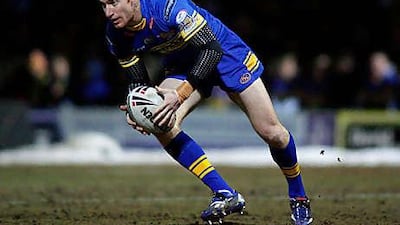

Scott Donald has warned his Leeds teammates to beware of a Wigan side with revenge on their minds when they clash at Headingley tonight in the English Super League. The Rhinos sent Wigan, the league leaders, crashing out of the Challenge Cup earlier in the season with a gutsy 12-10 win and Donald, the former Manly winger, believes they will still be hurting.

Michael Maguire, the Wigan coach, will miss the clash as he is still in Australia on compassionate leave. Assistant Shaun Wane, who oversaw the 46-0 destruction of Hull last Friday, again taking charge. But Donald, who scored 48 tries in the NRL with the Sea Eagles, insists Leeds must up their game after limping past struggling Salford 31-22 last weekend to move into the top four for the first time this season.

"We know Wigan are going to be smarting after what happened at our place in the Challenge Cup and we are going to have to be ready for that," said Donald. "They performed really well against Hull and are a top team so it's going to be extremely tough for us. We are going to have to improve a lot on Sunday's performance if we are to beat them again. It's really important that we are in the top four as there aren't many games until the end of the season now. We just have to keep working on our game and, looking back at last week, there's a lot still to be done."

In the NRL, the Canterbury Bulldogs host a South Sydney Rabbitohs team today featuring a man who ran riot against them in the last meeting between the two sides. Sam Burgess, the British forward who moved to Australia from Super League side Bradford in 2009, has excelled in the NRL and scored two tries in the Rabbitohs 38-16 defeat of the Bulldogs in April while generally terrorising their defence with his speed and strength.

The Bulldogs have lost 12 times this season, but that defeat was one of the few times they have been rolled over. Burgess played loose forward in that match, but is likely to be moved back to prop for the game today. The Rabbitohs are eighth in the NRL table. A victory over the 13th-placed Bulldogs would enhance their chances of making the end-of-season play-offs, which the top eight teams qualify for.

Elsewhere, the Penrith Panthers, in second, host third-from-bottom North Queensland Cowboys. * Agencies