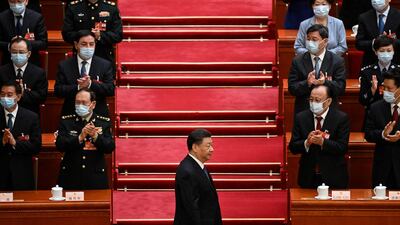

Among all the world leaders today, Chinese President Xi Jinping appears to be in the most comfortable position.

Last week, he was unanimously re-elected president for another five years. In October, he had been re-elected chairman of the Chinese Communist Party and head of the Central Military Commission.

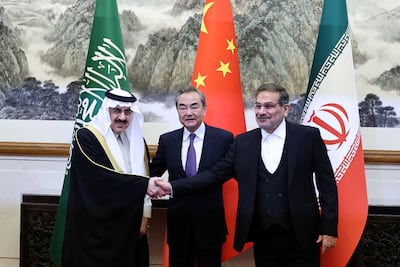

Then on Friday, Beijing sponsored an accord to restore diplomatic ties between Saudi Arabia and Iran, with the two countries agreeing to reopen their embassies and return to a security co-operation framework they signed in 2001. These agreements were announced in a joint Saudi-Iranian-Chinese statement confirming a future meeting between the Saudi and Iranian foreign ministers to implement further diplomatic steps. The statement also mentioned reviving co-operation agreements signed in 1998 in the fields of trade, investment, technology, science, culture and sports.

The Chinese involvement in reviving diplomatic relations between Riyadh and Tehran did not come as a surprise. Last December, I wrote in these pages: “Beijing wants to act as a bridge between Saudi Arabia and Iran and help defuse their tensions, believing it can play a successful role in ending the Yemen conflict … Tehran might resist these efforts, but Beijing’s leverage over it is substantial.”

Beijing will continue to monitor the rapprochement that comes after a years-long estrangement and that will have major implications for the Middle East. Its role in the negotiations is likely to raise concerns in Washington, too, as China’s political and economic clout has strategic dimensions, even if the US remains confident that its security relations with the Gulf states are yet unrivalled. However, Washington might also feel reassured by the rapprochement because it prefers an accord between Saudi Arabia and Iran. The Biden administration, after all, was indirectly involved in months-long negotiations with Tehran in Vienna over the latter’s nuclear weapons programme.

While Mr Xi appears unrivalled in China, US President Joe Biden can never dream of winning an election unanimously, given his country’s two-party system. From this lens, any American president would appear weaker than any Chinese president. But that doesn’t mean that the US’s administrative state is weaker than that of China. In fact, Washington’s civilian and military establishments are so strong that, despite China’s continued ascendancy (as seen in its deepening influence in the Middle East), America will continue to lead world for the foreseeable future.

Nonetheless, China today is at the top of America’s list of priorities, and classed as its main rival, with every move Mr Xi makes being closely watched in Washington.

The Chinese president is playing his cards carefully, most notably vis-a-vis the war in Ukraine.

Despite China’s favourable relations with Russia, Mr Xi has attempted to avoid being seen as an ally of the Russian leadership in its war effort. In recent weeks, Beijing has sought to play the role of mediator, reassuring European leaders and pushing back against American accusations that it intends to supply lethal aid to Russian forces.

The Chinese government has also yet to set an official date for Mr Xi’s planned visit to Moscow. Presumably, it is in no rush to do so – at least not until the trajectory of the war is clear following possible offensives from both sides in March and April. With the Biden administration stepping up its rhetoric against Beijing, particularly in the context of the war, Mr Xi will be keen not to fall into a trap of provocation.

Russia’s slide in the global arena, due to the Ukraine war, might be having an impact on its relationship with China. A pragmatic Beijing is focused on its strategic projects and its aspiration to become a superpower competing with, if not replacing, the US for global greatness. Its leadership has a vision and a roadmap, but it is ready to adapt as and when required. For example, necessity has required a reformulation of its relations with not just Russia but Iran, with the latter becoming a direct party to the Ukraine war, delivering military supplies to Russian forces.

Some in Tehran are trying to distance themselves from the war, claiming that the supply of Iranian drones to Russia is based on a deal made prior to the war. If anything, this reveals contradictions within Iran’s governing class.

With the battle for eventual succession atop Iran’s power structure having begun, some want to deal with the international community the way North Korea does, while others seek to resume talks with the West in the hope that this would lead to sanctions relief. In its broad outlines, the battle appears to be between the clerics and the generals running the Islamic Revolutionary Guard Corp.

The leadership in Tehran does not wield as much power inside Iran as the leadership in Beijing does in China. Iran today has to repress widespread and popular unrest that stands up to the regime and its practices. All this while, it has watched Beijing deepen its ties with the Gulf states, and lost any potential allies in Europe over its involvement in the Ukraine war.

It’s worth viewing the Saudi-Iran rapprochement in this context.

Beijing’s sponsorship of such important regional agreements follows on from the importance of mutual strategic trust that Mr Xi Jinping talked about during his visit to Riyadh last year. It is a key step towards increasing China’s influence in the Middle East, exactly as he has sought to accomplish with the precision, persistence and confidence of a leader comfortable in both his domestic and global positions.