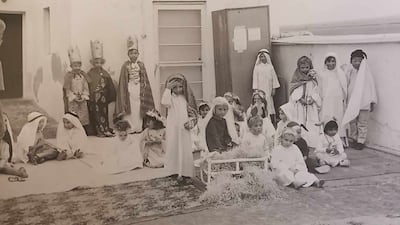

When the first pupils started at Sharjah English School in 1974, they had to stop work and cover their ears every time a plane landed. The handful of pupils were taught next to the runway of what was the modern UAE’s first airport.

Al Mahatta Fort, built in the 1930s to house overnight passengers travelling on Imperial Airways, was their first classroom. From those freewheeling years, Sharjah English School has soared to its current campus that accommodates more than 1,000 pupils and about 150 staff.

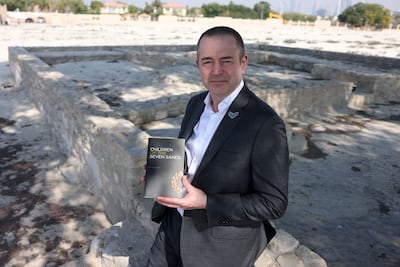

“I've described this school as a sort of a jewel in the desert that's covered with sand,” principal Darren Coulson told The National. “It doesn't have a high profile and I don't necessarily think it wants a high profile.“

“It is quite confident in itself and is quite a community-based school. I'm really proud that I'm here and we're celebrating the history of 50 years,” added Mr Coulson, who is from the UK and has worked in the region since the 1990s.

Unlocking memories

Sharjah English School marked its half century on Wednesday with events including the opening of a time capsule that was buried by pupils in 1999.

It was an era when cassettes, VHS tapes and Nokia mobile phones ruled supreme. All three came out of the capsule along with other items revealed by the school's head of primary, Shiobhain Brady, such as a digital watch, a local print newspaper, photos, physical money and work by previous pupils.

“It is quite emotional,” said Mr Coulson, about the opening of the capsule. “I had a tear in my eye. I'm really proud that the school is still here and thriving in quite a competitive world in the UAE, in terms of schools.”

Sharjah English Speaking School, as it was previously known, was founded in 1974 by two British bankers, David Eldon and David Bedford. Before this, children had to travel to Dubai.

The school initially operated from those temporary rooms in Al Mahatta Fort run by the first headmistress, Marie Gladstone. Ms Gladstone turned 100 this year and is back in the UK. Al Mahatta later became an RAF base and airport. Today it serves as an aviation museum.

How the school has changed

On Wednesday, pupils watched a presentation on the school's history and heard an interview with long-serving staff at the school. Afsar Khan, the operations assistant, joined the school in the mid-1970s, while Sharanjit Singh, site supervisor, joined in 2000. They have had front-row seats on changing and often challenging times.

Mr Khan, from Pakistan, remembers when camels used to wander into the grounds and help themselves to the foliage of ghaf trees. “There were so many stories,” he said. “I loved being part of the school and I grew old with it. There are no regrets,” Mr Singh, from India, said. “It has been 25 years. I'm always happy at the school.”

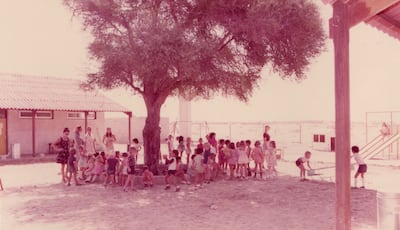

The need for more space and places for pupils meant the school moved several times. In 1975 it relocated to the Dasman area of Sharjah on land granted by Sheikh Dr Sultan bin Muhammad Al Qasimi, Ruler of Sharjah. Sports teams were also created, which led to Sharjah Wanderers sports club.

The school shifted to Samnan in 1978. A year later pupils travelled to Dubai in a double-decker bus to see Queen Elizabeth II, who was on her visit to the UAE.

It moved to its campus near University City of Sharjah in 2005, which has allowed it to provide primary and secondary education to its pupils.

To mark 50 years, the non-profit school has planted 50 trees, and will host a gala dinner at the end of the year to celebrate its rich history.

It is a long journey from the fort to the British curriculum, multicultural school consistently ranked as “outstanding” by the British School Overseas.

“We are hoping that in 50 years people will look back again and do a very similar event,” said Mr Coulson. “To survive for 50 years … is a heck of a thing.”