Two generals have been arrested on suspicion of taking bribes to waive customs duties, a practice estimated to cost the state $6.3 billion a year in lost revenues, the Iraqi government said on Saturday.

The arrests are part of a campaign announced by Prime Minister Mustafa Al Kadhimi last year to rein in rampant corruption at Iraq's ports.

Both men worked at the Gulf port of Umm Qasr, an entry point for imported foodstuffs and medicines that is reputed to be partly under the control of corrupt political parties and Iran-backed militias.

The sums allegedly found in their possession were tiny given the scale of corruption in Iraq, which is estimated to have cost the country hundreds of billions of dollars since the US-led invasion of 2003.

"$1,000 were found in the office of the general in charge of Umm Qasr North, while the other general had hidden $2,100 in a waste basket in his office," a source in the state anti-corruption body, the Commission for Integrity, told AFP.

"These were bribes intended to facilitate the smooth passage of cargoes," the source said.

Iraq’s border points have been plagued by corrupt officials appointed by political parties or armed groups, who ensure a steady flow of illicit revenue to their patrons.

In Umm Qasr, it is mainly pro-Iranian armed groups who dominate through their nominees in the customs department and the security forces, officials say.

Militias hold sway

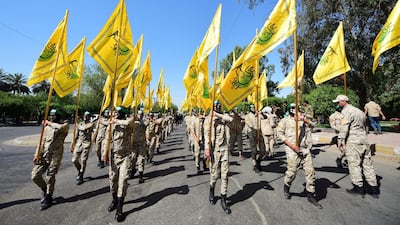

Mr Al Kadhimi faces an uphill struggle reining in militias linked to powerful political parties backed by Iran, who gain funds from the Iraqi state and have infiltrated government ministries and the security forces.

These groups, including militias within the state-sanctioned Popular Mobilisation Forces (PMF), have been working to implement Tehran’s foreign policy in Iraq. These include the ousting of US and other foreign coalition forces invited by the Iraqi government to help fight ISIS.

Iran-backed PMF groups also stand accused of killing hundreds of Iraqi protesters who are demanding an end to Iranian-influence, corruption and poor services.

Mr Al Kadhimi’s attempts to hold the groups to account have often stumbled.

In June 2020 the prime minister was pressured to release 14 members of the Kataib Hezbollah militia who were accused of attempting to fire rockets at foreign forces stationed within Baghdad international airport, and had been arrested at the scene by the state's Counter Terrorism Service.

Last week, the Iraqi Higher Judicial Council ordered the release of a PMF commander, Qassem Musleh, who was accused of murdering an activist and running protection rackets.

Militias are using murder and intimidation to force Mr Al Kadhimi into a corner and preserve their powerful role in the Iraqi state.

On June 7, the campaign to undermine his government took a more ominous turn when Col Nebras Shaban, an officer in the intelligence services, was shot dead near his home.

On Sunday, Mr Al Kadhimi visited “the family of the hero martyr Nibras Farman Shaban”, calling those responsible for his death “treacherous hands” who had “attempted to undermine the heroes of our security forces.”