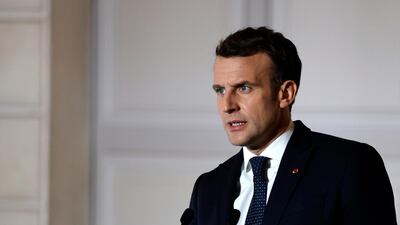

French President Emmanuel Macron on Tuesday asked Iranian leader Hassan Rouhani for "clear gestures" and an immediate return to the terms of a nuclear deal with western powers.

Mr Macron's office said that he also asked Mr Rouhani to co-operate fully with the UN nuclear watchdog, the International Atomic Energy Agency, on inspections and expressed his "deepest concern" over Tehran's breaches of the accord.

The 2015 deal has been in peril since former US president Donald Trump withdrew Washington from it and reimposed sanctions on Iran in 2018.

French Foreign Minister Jean-Yves Le Drian said on Tuesday that France, Britain and Germany would put forward a resolution at this week's meeting of the IAEA's board of governors condemning Iran's suspension of some nuclear inspections.

But Iran warned against such a move.

"I have to give this warning: that actions against our expectations will have adverse effects on diplomatic processes and can quickly close the windows of opportunity," said Iran's government spokesman, Ali Rabiei.

Iran expects "all parties to act rationally and prudently, and to know the value of fleeting moments", Mr Rabiei said. "We are still committed to diplomacy."

The Iranian Parliament in December passed a law suspending some of the deal's commitments if the US did not lift sanctions, or the three European countries did not help Tehran to bypass them.

Restrictions on inspections went into force on February 23.

Under the agreement with the IAEA, which runs for up to three months, data from cameras on Iran's nuclear programme will be stored and not handed over to the agency, and if sanctions are not lifted by that time, Tehran will start erasing the recordings.

Mr Rabiei said the agreement conveyed Tehran's "good-will", and now Iran expected other parties to the deal to prove theirs.

Diplomatic sources in Vienna say the European resolution is expected to face a vote on Friday, and that it is backed by the US.

US President Joe Biden has indicated his readiness to revive the deal but insists Iran must first return to all of its nuclear commitments, most of which it suspended in response to the sanctions.

Tehran demands that Washington take the first step by scrapping the sanctions.

Iran on Sunday dismissed a European offer for an informal meeting involving the US on the deal, saying the time is not right because Washington has not lifted the sanctions.