James Smith has come a long way in five years. From having a few clients as a personal trainer to gaining more than one million Instagram followers, three bestselling books and sold-out talks around the world, his rise has been rapid, but not always smooth.

“The whole thing just kind of got carried away,” he says. “My ultimate goal at the beginning of this was to have 10 very high-paying clients that I worked with in London, do something like 30 hours of PT per week and I thought that would be my life.”

As it turned out, Smith’s no-nonsense approach to fitness — and specifically calling out what he deems to be false and unhealthy narratives pedalled on social media — meant that there were far more than 10 people willing to give him their money.

His straightforward, and at times abrasive, approach has landed him in hot water on occasion, however, Smith’s not here to please the masses.

“I’ve had a few defamation cases across the years,” he says. “It’s my own personal opinion, and as long as I am entitled to that, then yeah, I will always be the voice that other people can’t be. I’ve never really had the desire or need for recognition.”

Smith decided to leave his office job to pursue a career in fitness in his early twenties out of frustration, both for the corporate world and the health industry. His nine-to-five was making him miserable and as an overweight child, he’d worked hard to figure out his way to a healthy lifestyle, but not without making a few mistakes along the way.

“I’d be sitting at my desk reading articles about nutrition and training, most of which were inaccurate,” he says. “I had a bit of a chip on my shoulder about all the misinformation I had been taught over the years, so I became a trainer myself.”

From detox teas to fad diets, Smith’s expletive-laden Instagram takedowns have seen him labelled the Gordon Ramsay of the fitness world.

“A lot of the time people overcomplicate stuff to make things seem like they’re not,” he says. “I see things like ‘skipping breakfast is going to add 20 years to your life’, and what annoys me is by letting people make these absurd claims, we are taking people further away from the habits that actually help make changes.

“There is so much more to it and so much else we need to be taking into account — stress levels, mental health, sleep, step count — it needs to be a multi-faceted approach. I get very annoyed when people become so siloed on one thing.”

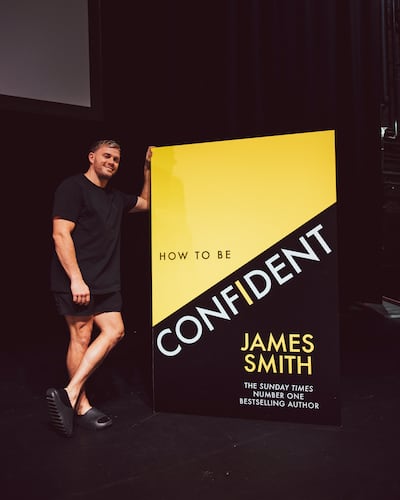

In his third book, How to Be Confident, Smith’s advice stretches beyond the fitness industry. But, as his second book is titled, he is absolutely, most definitely, not a life coach.

“It’s about trying to share a different opinion with people without trying to be their life coach,” he says. “One, I don’t think I’m qualified. Two, I don’t have all the answers. What I do have is a set of experiences — a lot of the time when I am writing the books I think to myself: ‘Am I really in a position to be giving this advice?’ But then I think here is a set of rules and principles that work for me, so they could also help someone else."

And despite the book title, and Smith’s Instagram persona, confidence is not something that has always come easily to him.

“I wouldn’t say I am a very confident person, but I have a very good relationship with things not going right and things failing,” he says. “I would post social media posts that would get three likes or videos that would get 10 views, but it was my relationship with failure that set me apart from other coaches because it didn’t make me stop.

“I used to work in door-to-door sales, I used to have to knock on 100 doors to make a sale, so growing a very thick skin and an air of understanding for the amount of times you have to do something before you succeed with it made me bulletproof to the disheartening realities of the world.

“And with the confidence book, if I were to summarise the final closing sentence of the book, I’d say it’s not about confidence, it’s about taking action. Every time we are presented with a belter in the road, we can either pick a path of action or inaction, and if you need a guise to masquerade always choosing that path of inaction, nothing is better than the self-label of not being confident. The more people manifest that reality and their identity of not being a confident person, the easier it is to duck out of opportunities to take action, so the book is really about getting people to take action.”

Smith is in Dubai for his sold-out talk, The C Word, at Dubai World Trade Centre on Friday before his appearance and meet-and-greet at Dubai Active this weekend. “I’m really looking forward to it,” he says. “To do a show for 1,500 people is absolutely insane, especially in a country I don’t live in.”

He has also made sure to make the most of his downtime in the city, finding plenty of future motivation in the process. Smith wanted his friend to join him at one of the city’s sky pools, which was only for paying hotel guests.

“I had to pay for a room for him so he could use the pool, which felt like the most stupid thing to do in the world,” he says. “But equally, I felt the experience of us being up there would be the perfect motivating moment for the next year, and a glimpse into how the future could look. So for me, if I can get 12 months’ motivation from one day's stupid money spending, I think that’s a good deal. For me, motivation is something that can be bought in some ways.”

Smith will be at Dubai Active on Saturday to meet visitors. General admission tickets for the day cost Dh120, weekend admission tickets are Dh150 and are available at dubaiactiveshow.com