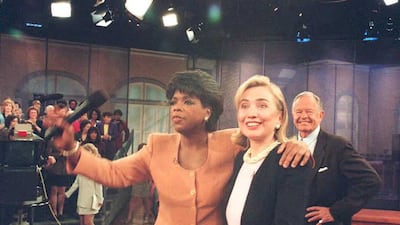

Oprah Winfrey's style of interview has won her much praise over her five-decade career, and her personal style has been quite the talking point, too.

In the 1970s, 1980s and 1990s, the broadcaster favoured power suits and sequins, while in recent decades, she has been known to turn to show-stopping, belle-of-the-ball red carpet gowns.

Winfrey has dabbled in pretty much every trend going, with fur coats, fringing and statement shoulder pads all making appearances in her early wardrobe. Her love of sparkling detail, however, has remained consistent throughout.

Scroll through the gallery above to see Oprah Winfrey's style evolution through the years.

If there is one sartorial move that the talk show queen is not afraid of, it's colour blocking. The media mogul has been known to go head-to-toe in orange, pink, turquoise, gold, burgundy and navy, to name just a handful of hues.

While a loyal devotee of Stella McCartney's designs – she chose a piece by the designer for Prince Harry and Meghan Markle's 2018 wedding – she has an eclectic designer palate, with Azzedine Alaia, Vera Wang, Victoria Beckham and Atelier Versace all making appearances over the years.