Jordan's treasury bills offer attractive yields compared with US and regional gulf markets, Standard Chartered said yesterday.

The one-year spreads between Jordanian treasury bills and the greenback, the Saudi Arabian riyal and UAE dirham are at 450 basis points, 367 and 360 respectively.

Jordan's central bank regularly auctions the sale of conventional treasury bills and bonds. It issued its latest three-year bond with a coupon of 7.3 per cent last month.

"These opportunities may be of interest to investors who share the view that the Jordanian dinar peg will not change in the year," said Sayem Ali, an economist at Standard Chartered.

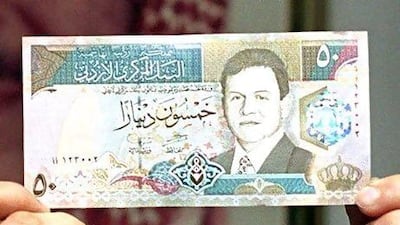

The Jordanian dinar currently stands at US$1.41.

Public debt has increased to $17.3 billion, accounting for 58.7 per cent of GDP at the end of last year, according to a report published in May.

Higher wages and salaries raised the deficit to $503 million from January to May, an increase of 38 per cent from the same period last year.

This year's budget initially targeted a deficit of 5 per cent of GDP, the same level as last year. However, populist measures are likely to push it closer to 7 per cent, Mr Ali said.

Street protests have taken place in Jordan amid a wave of civil unrest that has spread through several Arab states and ousted leaders in Tunisia, Egypt and Libya.

The GCC has accepted Jordan's request for membership and the first round of talks begins this month.

"This will give Jordan preferential access to the lucrative GCC markets, bringing significant economic benefits," Mr Ali said.

Saudi Arabia has pledged grants totalling $1.4bn to Jordan's government of which $400m was released in April.