This is no ordinary bank. The ATM instructions are in Latin. Priests use a private entrance. A life-size portrait of Pope Benedict XVI hangs on the wall.

But the Institute for Religious Works is a bank - and it's under harsh new scrutiny in a case involving money-laundering allegations that led police to seize €23 million (Dh111.3m) in Vatican assets in September. Critics say the case shows that the "Vatican Bank" has never shed its penchant for secrecy and scandal.

The Vatican calls the seizure of assets a "misunderstanding" and expresses optimism it will be quickly cleared up. But court documents show prosecutors say the Vatican Bank deliberately flouted anti-laundering laws "with the aim of hiding the ownership, destination and origin of the capital". The documents also reveal investigators' suspicions that clergy may have acted as "fronts" for corrupt businessmen and Mafia.

The documents pinpoint two transactions that have not been reported: one last year involving the use of a false name and another this year in which the Vatican Bank withdrew €650,000 from an Italian bank account but ignored bank requests to disclose where the money was headed.

The new allegations of financial impropriety could not come at a worse time, even though the corruption investigation has given new hope to Holocaust survivors who tried unsuccessfully to sue in the US, alleging that stolen Nazi cash and treasure was stored in the Vatican Bank.

Yet the scandal is hardly the first for the bank. In 1986, a Vatican financial adviser died after drinking cyanide-laced coffee in prison. Another was found dangling from a rope under London's Blackfriars Bridge in 1982, his pockets stuffed with money and stones. The incidents blackened the bank's reputation, raised suspicions of ties with the Mafia and cost the Vatican hundreds of millions of dollars in legal clashes with Italian authorities.

On September 21, police seized assets from a Vatican Bank account at the Rome branch of Credito Artigiano. Investigators say the Vatican failed to furnish information on the origin or destination of the funds as required by Italian law.

The bulk of the money, €20m, was destined for JPMorgan in Frankfurt, with the remainder going to Banca del Fucino.

Prosecutors allege the Vatican ignored regulations that foreign banks must communicate to Italian financial authorities where their money has come from. All banks involved have declined to comment.

In another case, police in Sicily said in late October they uncovered money laundering involving the use of a Vatican Bank account by a priest in Rome whose uncle was convicted of Mafia association.

Authorities say some €250,000, illegally obtained from the regional government of Sicily for a fish breeding company, was sent to the priest by his father as a "charitable donation".

It was then sent back to Sicily from a Vatican Bank account using a series of home banking operations to make it difficult to trace.

The prosecutors' office stated in court papers last month that while the bank had expressed a "generic and stated will" to conform to international standards, "there is no sign that the institutions of the Catholic church are moving in that direction".

Legal waters are murky because of the Vatican's special status as an independent state within Italy. This time, Italian investigators were able to move against the Vatican Bank because the Bank of Italy classifies it as a foreign financial institution operating in Italy.

Even so, in one of the 1980s scandals, prosecutors could not arrest the then head of the Vatican Bank Paul Marcinkus, a US archbishop, because Italy's highest court ruled he had immunity.

Archbishop Marcinkus, who died in 2006 and always proclaimed his innocence, was the inspiration for Francis Ford Coppola's character Archbishop Gilday in the film Godfather III.

The Vatican has pledged to comply with EU financial standards and create a watchdog authority. Gianluigi Nuzzi, the author of Vatican SpA, a book published last year outlining the bank's dealings, says it is possible the Vatican is serious about coming clean, but he is not optimistic.

"I don't trust them," he says. "After the previous big scandals, they said 'we'll change' and they didn't. It's happened too many times."

He says the structure and culture of the institution is such that powerful account holders can exert pressure on management and some managers are simply resistant to change.

The list of account holders is secret, although bank officials say there are up to 45,000 among religious congregations, clergy, Vatican officials and lay people with the right connections.

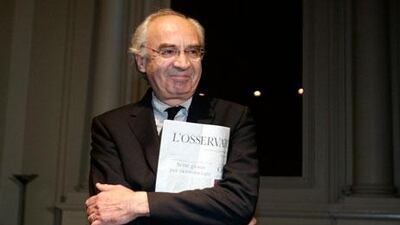

The bank chairman is Ettore Gotti Tedeschi. He was brought in last year to bring the operation in line with Italian and international regulations. Mr Gotti Tedeschi has been on a public speaking tour extolling the benefits of a morality-based financial system.

"He went to sell the new image … not knowing that inside, the same things were still happening," Mr Nuzzi says. "They continued to do these transfers without the names, not necessarily in bad faith, but out of habit."

It does not help that Mr Gotti Tedeschi and the bank's director general, Paolo Cipriani, are under investigation for alleged violations of money-laundering laws. They were both questioned by Rome prosecutors on September 30, although no charges have been filed.

In his testimony, Mr Gotti Tedeschi said he knew next to nothing about the bank's day-to-day operations, noting that he had been on the job less than a year and only works at the bank two full days a week.

According to the prosecutors' transcripts, Mr Gotti Tedeschi deflected most questions about the suspect transactions to Mr Cipriani. Mr Cipriani in turn said that when the Holy See transferred money without identifying the sender, it was the Vatican's own money, not a client's.

Mr Gotti Tedeschi declined a request for an interview but says he questioned the motivations of prosecutors. In a speech in October, he described a wider plot against the church.

As the Vatican proclaims its innocence, the courts are holding firm. An Italian court has rejected a Vatican appeal to lift the order to seize assets.

The Vatican Bank was founded in 1942 by Pope Pius XII to manage assets destined for religious or charitable works. Located in the tower of Niccolo V, the bank is not open to the public.

Top prelates, such as bishops, have a special entrance manned by security guards. There are about 100 staff, 10 bank windows, a basement vault for safe deposit boxes, and ATMs that open in Latin but can be accessed in modern languages. In another concession to modern times, the bank recently began issuing credit cards.

In the scandals two decades ago, the Sicilian financier Michele Sindona was appointed by the pope to manage the Vatican's foreign investments. He also brought in Roberto Calvi, a Catholic banker in northern Italy.

Sindona's banking empire collapsed in the mid-1970s and his links to the mob were exposed, sending him to prison and his eventual death from poisoned coffee. Calvi then inherited his role.

Calvi headed the Banco Ambrosiano, which collapsed in 1982 after the disappearance of $1.3bn (Dh4.77bn) in loans made to dummy companies in Latin America. The Vatican had provided letters of credit for the loans.

Calvi was found a short time later hanging from scaffolding on Blackfriars Bridge, his pockets loaded with 5kg of bricks and $11,700 in various currencies. After an initial ruling of suicide, murder charges were filed against five people, including a major Mafia figure, but all were acquitted after trial.

While denying wrongdoing, the Vatican Bank paid $250m to Ambrosiano's creditors.

Both the Calvi and Sindona cases remain unsolved.

* Associated Press