Fuel prices below $60 a barrel would be the sweet spot for airlines, according to the chairman of Dubai-based aviation giant Emirates and its budget sister carrier Flydubai, after both airlines reported a dent in profits from rising fuel bills.

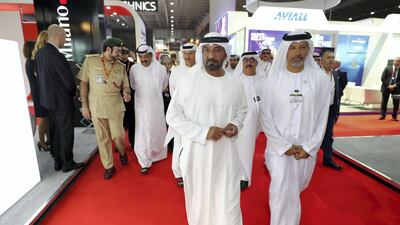

"From an airlines point of view, they want to see it below 60," Sheikh Ahmed bin Saeed Al Maktoum said when asked by The National about optimum fuel prices for the industry during the Middle East Business Aviation Association show (MEBAA) in Dubai on Monday.

Global airlines’ profits will drop 12 per cent this year from record levels in 2017, weighed down by rising fuel and labour costs, the International Air Transportation Association said in June. Their fuel bill will account for 24 per cent of total operation costs this year, up from 21.4 per cent in 2017.

Higher oil prices are a double-edged sword for airlines regionally. In the Middle East higher crude prices have spurred demand for premium travel in a region at the heart of global oil and gas production but also inflated fuel costs that weigh on earnings. Emirates group posted a 53 per cent decline in first-half profits, while the airline's bottom line plunged 86 per cent on the back of a bigger fuel bill and foreign-currency swings. Flydubai has said it is facing a tough year from rising oil prices.

Oil prices have recovered from three-year lows to hit $80 a barrel this year but that growth has recently dropped to $62 per barrel.

“When we talk about the airline business and profitability, it’s affected by geopolitics, currency and fuel,” Sheikh Ahmed told reporters at MEBA. “It’s not the first time that any airline had its ups and downs.”

Emirates rebounded in its 2017 fiscal year, with the airline more than doubling its profit to Dh2.8 billion in its fiscal year ending March 31, 2018 in stark contrast to a slump the previous year.

_______________

Read more:

Emirates' first-half profit slides as fuel bill climbs

What makes Emirates the most popular place to work for UAE millennials?

Plugged in planes - future of aviation looks electrifying

_______________

Sheikh Ahmed said he was not concerned about the remaining deliveries and specifications of the Boeing 737 Max jets to Flydubai, the biggest regional customer of that aircraft, following Indonesia's Lion Air Max plane crash in October. The chairman said he was confident in the Boeing 737 Max jet when asked whether he had any concerns about the delivery schedule of orders and specifications of the re-engined single-aisle planes to Flydubai following the Lion Air plane crash.

“We always knew that aircraft can come up with a snag, especially when they’re newly launched,” he said. “I’m sure that Boeing will manage.”

Questions regarding the jet model arose following the fatal crash of a two-month old Max jet belonging to Lion Air that have hung over the US-based planemaker. The accident raised questions about whether Boeing shared sufficient information with airlines, pilots and regulators about the systems on the plane.

Boeing has delivered 241 of the jets to customers since it entered service last year, according to its website. A further 4,542 have been ordered but not yet delivered.

Lion Air has threatened to cancel its $22 billion Max order while its local rival Garuda said it will continue taking deliveries of its Max jets, Bloomberg reported last week.

Major operators of the Max include Southwest Airlines, American Airlines, Norwegian, Lion Air, Air Canada, China Southern, China Eastern and flydubai.

Sheikh Ahmed was speaking at the MEBAA Airshow on Monday where plane makers including Boeing, Airbus, Embraer, Bombardier and Dassault showcased their executive jets in a static display.