Big technology companies are increasingly playing a role in reshaping banking and financial services which can help boost the inclusion of the unbanked across the globe and reduce transaction costs.

“Big Tech’s promise is to make payments and financial services as easy and as cheap as sending a text or a picture,” David Lipton, first deputy managing director of the IMF told a gathering at the fund’s headquarters in Washington DC. “This could potentially change and reshape the financial sector’s landscape for the future.”

Technology may emanate from Silicon Valley and its adoption at home in the US precedes its use elsewhere, however, nowhere is the impact clearer than in Africa and Asia. The mass market penetration of smartphones facilitated the financial inclusion of unbanked segments of the population in developing countries and helped streamline payment processes.

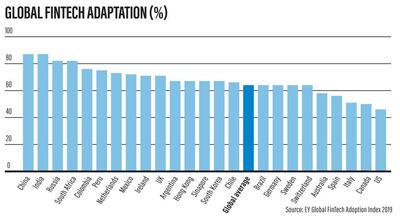

The adoption of FinTech services has moved steadily upward, from 16 per cent in 2015 to 33 per cent in 2017 and 64 per cent in 2019, according to EY’s Global FinTech Adoption Index. Of 27 markets surveyed globally, consumer FinTech adoption was 87 per cent in both China and India, 82 per cent in South Africa, 76 per cent in Colombia, 72 per cent in Mexico and 71 per cent in the UK.

The most commonly-used category is money transfer and payments, with 75 per cent of consumers using at least one service in this category and 64 per cent of those polled attracted by the lower fees associated with FinTech services.

For much of the past decade India has put in place building blocks to digitise public infrastructure. About 1.2 billion people in Asia’s third-largest economy today have a digital ID — the base for electronic verification of an individual's identity, referred to as e-KYC (know your customer), according to Nandan Nilekani, cofounder and chairman of Infosys Technologies, who took part in the discussion at the IMF. With bio-metrics, people can open a bank account within minutes in a manner fully compliant with anti-money laundering and counter-terrorism laws.

Thanks to the new technology, India’s government went live with a programme in 2014 that has led to 330 million new bank accounts opening — a process that would normally take 46 years, said Mr Nilekani.

“E-KYC was essential to financial inclusion because if people don’t have an identity, they can’t open a bank account or get access to financial services,” he said. Developing a payment system was the second component and the platform was designed by the central bank and the banks themselves.

“The uniqueness of this model is that Big Tech participates along with the banks,” said Mr Nilekani, adding that six different entities signed up to take part.

Last month, the platform processed 955 million transactions worth about $23 billion (Dh84bn), according to Mr Nilekani.

“This has shown that you can have an architecture [and] that you get all the benefits you talk about: convenience, instant payments, get them cheap with instant provisioning and you can do it within the system,” he said.

Key to the success of India's platform is its interoperability, allowing transactions to take place between customers using different forms of payment channels in conjunction with financial institutions and the regulator.

“The India model is important because it’s an open access model, it allows any Big Tech to participate, but they have to come through the banks, and it is interoperable … the heart of payments is interoperability. Payment is so fundamental to an economy that you need an interoperable payment system,” said Mr Nilekani.

About 1.7 billion people across the globe do not have access to digital money and sending money across borders costs an average 7 per cent of the transaction, said David Marcus, a former president of PayPal who now heads Calibra, the Facebook-owned digital wallet set up for the new Libra cryptocurrency. Though communicating costs have been drastically reduced with the coming of the digital age, the same isn’t true of financial services when it comes to transaction costs.

“Digital money is only for people who have the devices on which they can store the digital money, in other words you need to have a smartphone to keep the digital money,” said Mr Nilekani. “If you really want financial inclusion for the world you have to think of those who have no bank accounts, those who have no IDs and how to get them IDs and so on.”