Global smartphone production is projected to increase by almost 9 per cent to 1.36 billion units in 2021, after it fell 11 per cent year-on-year in 2020 amid the pandemic-induced economic slowdown, according to a new report.

Only1.25 billion smartphones were produced globally last year, as Covid-19 hit discretionary spending and upended supply chains of phone manufacturers, Taipei-based market intelligence firm TrendForce said in its latest findings.

“Market will gradually recover as people become accustomed to the new normal resulting from the pandemic,” it said

This year will see a “strong wave of device replacement demand” as well as “demand growth in the emerging markets”.

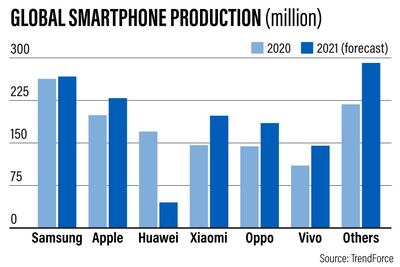

South Korean manufacturer Samsung led the industry with almost 21 per cent market share in 2020, producing 263 million handsets last year. It was followed by the US technology giant Apple, which made 199 million handsets, and Chinese brand Huawei, with 170 million handsets, grabbing 16 per cent and 14 per cent market share, respectively.

Shenzhen-based Huawei, which for the first time reached the number one position in the smartphone industry with 20 per cent market share in the second quarter of last year, is expected to see a significant decline in smartphone manufacturing this year.

Its inability to secure enough crucial components and software needed to manufacture smartphones and US restrictions on the company, will drive down production. TrendForce predicts Huawei to slip from the third place in 2020 to the seventh spot this year.

“This is because of the effects of the US export restrictions and the spin-off of Honor as a separate entity operating in the smartphone market,” it said.

Last November, Huawei sold its Honor smartphone business to a Chinese government-backed consortium for an undisclosed amount.

The top six smartphone makers in 2021 will be Samsung, Apple, Xiaomi, Oppo, Vivo, and Transsion. Together, they will account for almost 80 per cent of the global smartphone market.

Looking forward, the research firm said the Covid-19 pandemic will remain the “central variable or the biggest uncertainty” in the smartphone industry.

“It will continue to exert significant influence on the global economy. Besides the pandemic, the performance of smartphone brands during 2021 could also be affected by geopolitical instabilities and the lack of available production capacity in the semiconductor foundry market,” it added.

With the wider rollout of fifth-generation network expected this year, the penetration rate of 5G smartphones is likely to rise to 37 per cent in 2021, to about 500 million units.

“Thanks to the Chinese government’s aggressive push for 5G commercialisation in 2020, global 5G smartphone production reached about 240 million units [in 2020], a 19 per cent penetration rate … with Chinese brands accounting for almost a 60 per cent market share,” according to the TrendForce report.

However, the next wave of demand for 5G devices is expected to come from North America and Europe, areas with relatively big installed base of Apple users.

“There is large pent-up demand for 5G upgrades, especially within the iOS base, which is now getting converted into sales", Varun Mishra, research analyst at Counterpoint Research, said

"This was complemented by strong carrier promos, especially in the US, which accounted for more than one-third of the iPhone 12 and 12 Pro sales in October.”

Apple launched its first 5G-enabled iPhone 12 series in October, while its main competitors Samsung and Huawei launched their first models in 2019.