Nvidia chief executive Jensen Huang has unveiled a new batch of products and services tied to artificial intelligence as it pushes to capitalise on a frenzy that has made his company the world’s most valuable chip maker.

The wide-ranging line-up includes a new robotics design, gaming capabilities, advertising services and networking technology.

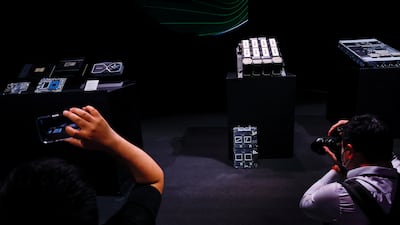

Perhaps most central to his ambitions, Mr Huang, 60, took the wraps off an AI supercomputer platform called DGX GH200 that will help technology companies to create successors to ChatGPT. Microsoft, Meta Platforms and Alphabet’s Google are expected to be among the first users.

“It’s too much,” he said near the end of his two-hour presentation at the Computex show in Taiwan. “I know it’s too much.”

The flurry of announcements underscores Nvidia’s shift from a maker of computer graphics chips to a company at the centre of the AI boom.

Last week, Mr Huang gave a stunning sales forecast for the current quarter – about $4 billion above analysts’ estimates – driven by demand for data-centre chips that handle AI tasks.

That sent the stock to a record high after an $184 billion rally, putting Nvidia on the brink of a $1 trillion valuation – a first for the chip industry.

In the presentation Monday, Mr Huang argued the traditional architecture of the technology industry is no longer improving fast enough to keep up with complex computing tasks.

To realise the full potential of AI, customers are increasingly turning to accelerated computing and graphics processing units, or GPUs, such as those made by Nvidia.

“We have reached the tipping point of a new computing era,” Mr Huang said, as he paced the stage in a trademark leather jacket.

Mr Huang also showed off the mind-bending capabilities of generative AI to take inputs in the form of words and then put out other media.

In one case, he asked for music to match the mood of early morning. In another, he laid out a handful of lyrics and then used AI to transform the idea into a bouncy pop tune.

“Everyone is a creator now,” he said.

Mr Huang showed how Nvidia is teaming up with WPP to use AI and the metaverse to lower the cost of producing advertising.

It is releasing a networking offering that is designed to turbocharge the speed of information within data centres.

And the company is even looking to change how people interact with video games: A service called Nvidia ACE for Games will use AI to enliven background characters and give them more personality.

Mr Huang also unveiled a new robotics platform aimed at helping Nvidia to expand to industries beyond technology.

It is a reference design that will help other companies build their own robots for use in a range of activities. In heavy industry, for example, he sees opportunities in using robots in factories and warehouses.

The DGX computer is another attempt to keep data centre operators hooked on to Nvidia’s products. Microsoft, Google and their peers are all racing to develop services similar to OpenAI’s ChatGPT chatbot – and that requires plenty of computing horsepower.

To satisfy this appetite, Nvidia is both offering equipment for data centres and building its own supercomputers that customers can use. That includes two new supercomputers in Taiwan, the company said.

One of the biggest AI bottlenecks is the speed at which data moves within data centres.

Nvidia’s Spectrum X, a networking system that uses technology acquired in the 2020 purchase of Mellanox Technologies, will address that issue. And the company is building a data centre in Israel to demonstrate how effective it is.

Meanwhile, the WPP partnership will streamline the creation of advertising content. The UK advertising titan will use Nvidia’s Omniverse technology to create “virtual twins” of products that can be manipulated to customise advertisements and reduce the need for costly reshoots.

Nvidia’s original business was selling graphics cards to gamers, and it is returning to that world with the ACE offering. The service will address the problem of NPCs, or non-player characters, the background figures that populate video games.

NPCs typically give repetitive responses with scripted dialogue, and that limited range has made them the subject of ridicule in memes and even the Ryan Reynolds movie “Free Guy”.

Nvidia ACE will listen to what the gamer says to a character, convert it into text and then dump that into a generative AI program to create a more natural, off-the-cuff response.

The Santa Clara, California-based company is currently testing the service and will add guardrails to ensure that responses are not inappropriate or offensive.