Saudi Arabia's gaming industry received a boost with new funding worth $488 million, as the kingdom pushes forward in positioning itself as a global leader in the industry.

The financing is being provided by the Saudi Esports Federation, National Development Fund and the Social Development Bank. It targets both the gaming and e-sports sectors, Rawan Al Butairi, the federation's senior director of international affairs, said at the Leap technology exhibition in Riyadh on Wednesday.

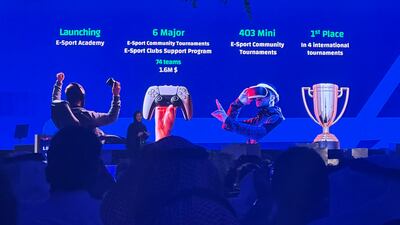

“Our aspirations are bold and promises are big, and we matched this by delivering exceptional results in 2022,” Ms Al Butairi said. “We shall do so again in 2023.”

Saudi Arabia's Ministry of Media and the Centre for Government Communication also launched an apprenticeship programme, partnering with 30 companies for training opportunities in 2023, while developer Playhera announced a $100 million cloud gaming platform to support the industry.

Also at Leap, Unity Technologies, the US software development company, announced the first Unity Academy in the Middle East and Africa.

The academy “marks a new era to make Saudi Arabia the leading gaming sector by 2030”, Faris Alsaqabi, Saudi Arabia's Deputy Minister of Future Jobs and Capabilities at the Ministry of Communications and Information Technology, said at Leap.

“This will be driven by the creativity and energy of citizens and gamers, who are at the heart of this strategy.”

The gaming industry in Saudi Arabia, the Arab world's biggest economy, is poised to grow 250 per cent by 2030, with e-sports leading the growth, a recent study from YouGov found.

The growth would mean that its contribution to Saudi Arabia's gross domestic product will have surged about 50 times by 2030 compared with 2022, the London-based market research company said.

Gaming consumption in the kingdom is projected to hit $6.8 billion by 2030, growing at a compound annual rate of 22 per cent, the Boston Consulting Group said in a recent report.

The number of gaming start-ups in Saudi Arabia, meanwhile, almost doubled to 24 in 2022 from 13 last year, driven by incubation programmes, a report from game developer support system Nine66 said in December.

Gaming has become a big business globally, with new technology providing both an opportunity to reach a wider audience and develop new titles to cater to consumer demand.

Revenue in the global games market is projected to grow nearly 15 per cent to $211.2 billion by 2025 from an estimated $184.4 billion in 2022, the latest data by research company Newzoo showed.

Mobile games alone accounted for $92.2 billion, which is about half of the overall figure.

senior director of international affairs at the Saudi Esports Federation

The Middle East is last among the five regions surveyed by Newzoo, with revenue pegged at $6.8 billion last year, accounting for 6.6 per cent of the global figure. However, it still posted the highest annual growth of 4 per cent in 2022.

The Middle East — along with Africa, the Asia-Pacific and Latin America — will drive the growth in players over the next several years, Newzoo said.

Meanwhile, the global e-sports market is expected to grow to $5.48 billion by 2029, from $1.44 billion in 2022, at a compound annual rate of 21 per cent, data from Fortune Business Insights show.

In September, Saudi Crown Prince Mohammed bin Salman unveiled the National Gaming and Esports Strategy, outlining a comprehensive investment programme for the industry, with the goal of making the kingdom a global gaming centre by 2030.