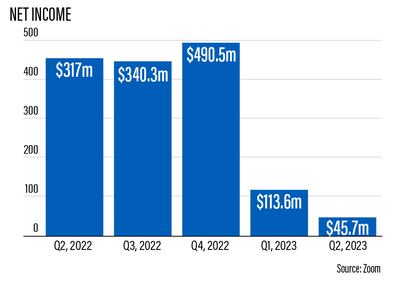

Zoom Video Communications’ shares fell more than 8 per cent in after hours trading on Monday after the company reported an 86 per cent drop in its fiscal second-quarter net income.

The company’s net profit attributable to common stockholders in the three-month period to the end of July dropped to $45.7 million, from 316.9m in the same period a year earlier, the Nasdaq-listed company said. Net income fell 60 per cent from the first quarter of this year.

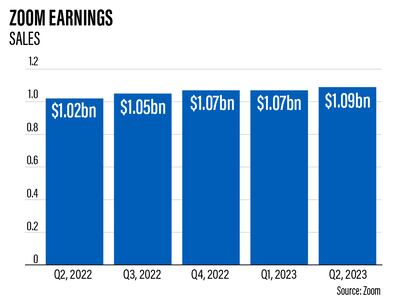

Revenue for the May-July period jumped 8 per cent on an annual basis to nearly $1.10 billion, missing the average $1.12bn estimate of analysts polled by Refinitiv. It was the company’s fifth straight quarter with revenue of more than $1bn.

Zoom’s chief financial officer

“The revenue results are disappointing and below our expectations … while we saw continued momentum with our enterprise customers … our revenue was impacted by the strengthening of the US dollar, performance of the online business, and to a lesser extent sales weighted to the back end of the quarter,” said Kelly Steckelberg, Zoom’s chief financial officer.

A stronger US dollar had an impact of about $8m on Zoom sales, the company said.

“We have moved beyond the pandemic buying patterns, we are returning to more normalised enterprise sales cycles … Zoom is not immune to the global downturn, but the situation is more complex than meets the eye,” she added.

Zoom shares, which were trading at $97.44 at the close of market on Monday, dropped to $89.35 in extended-hours trading. The company’s stock has dropped about 47 per cent since the start of the year.

The company also issued a weaker-than-expected revenue outlook for the current quarter and the full financial year.

Third-quarter revenue was forecast in the range of $1.09bn and $1.1bn, while diluted earnings per share is expected to be between 82 cents and 83 cents. Analysts polled by Refinitiv had predicted $1.15bn in revenue and 91 cents in earnings per share.

The company said it expects full-year revenue to be between $4.38bn and $4.39bn — about 4.4 per cent less than the predictions made in May.

“This outlook is consistent with what we are observing in the market today … we are taking a prudent and cautious approach in this environment with focused investments and hiring to drive innovation and customer happiness,” Ms Steckelberg said.

Zoom said its second-quarter revenue growth was mainly driven by “acquiring new customers and expanding across existing customers”.

At the end of the second quarter, Zoom had about 204,100 enterprise customers, up 18 per cent on a yearly basis.

“In the second quarter, we continued to gain traction as the platform of choice for enterprises looking to deliver flexible, productive solutions for collaboration and customer engagement,” Zoom’s founder and chief executive Eric Yuan said.

“Businesses are drawn to the Zoom platform because of our innovation and modern architecture,” he added.

Zoom, which became an essential service for office meetings and family gatherings during the Covid-19 pandemic, invested $172.6m in research and development in the three months to July 31, almost 109.6 per cent more than the prior year period. This was more than 15.6 per cent of the total revenue earned during the quarter.

The company has strong margins and cash flows as well as a large cash balance, Ms Steckelberg said.

Net cash provided by operating activities was $257.2m for the second quarter, compared to $468m in the same period last year. Adjusted free cash flow was $222m, compared to $455m in the prior year period.

The company's total cash, cash equivalents and marketable securities, excluding restricted cash, stood at $5.5bn on July 31.

The company said it purchased $426m of stock, representing 4.1 million shares, over the past two quarters as part of its billion-dollar repurchase programme.

In the last quarter, Zoom entered into a definitive agreement to acquire Solvvy, a conversational artificial intelligence and automation platform for customer support. The companies said they aim to capitalise on new opportunities in contact centre and customer support industries.