Tesla is already producing what chief executive Elon Musk views as “robots on wheels”, so it should come as little surprise to know that his company, the world's most valuable car maker, is also creating humanoid robots.

And when we say robots, that does mean the type we see in Hollywood sci-fi movies, where they move around and perform meaningful functions.

Here's what we know so far about the Tesla Optimus robot:

When will Optimus be ready?

The indication is that it is not too far off after the robot went on show at Tesla's AI Day on September 30.

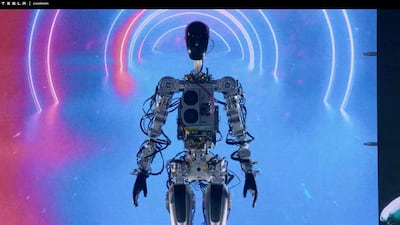

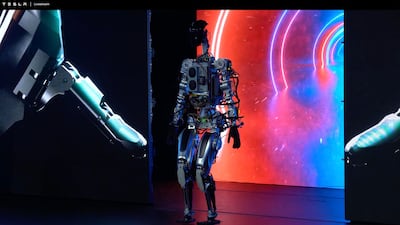

The prototype walked out on stage and waved to the crowd before a video showed it doing simple tasks, such as watering plants, carrying boxes and lifting metal bars at a production station at the company's California plant.

Optimus, which was originally known as the Tesla Bot, was introduced in August 2021 during Tesla’s inaugural AI Day.

Tesla also unveiled a new computer chip at the event last year. The chip was designed entirely in-house and will be used in the company’s supercomputer, Dojo.

Mr Musk said existing humanoid robots are “missing a brain” — and the ability to solve problems on their own.

By contrast, he said, Optimus would be an “extremely capable robot” that Tesla would aim to produce in the millions. He said he expected they would cost less than $20,000 each.

Tesla is on a hiring spree for people to work on humanoid bipedal robots, with about 20 job postings on Tesla Bot, including jobs for designing parts such as actuators, Reuters reported.

“The code you will write will at term run in millions of humanoid robots across the world, and will therefore be held to high quality standards,” one of the job postings said.

What will Optimus look like and do?

The adult-sized robot is set to be about 173 centimetres tall and weigh about 57 kilograms. It will be programmed to do monotonous jobs such as assembling car parts, moving components around factories and picking up groceries.

Optimus will one day have “the potential to be more significant than the vehicle business over time”, Mr Musk has said.

It will be controlled by the same artificial intelligence systems that Tesla is developing for use in its electric vehicles.

In the future, “physical work will be a choice”, Mr Musk said. “Tesla is arguably the world’s biggest robotics company. Our cars are basically semi-sentient robots on wheels.”

Unlike in a host of movies, Mr Musk said the robot will be “friendly”, and is being built by humans for humans.

“At a mechanical level, you can run away from it — and most likely overpower it,” he said.

Technical imagery of the Optimus robot shows it with a screen for useful information within the head area. It will be made of lightweight materials, contain 40 electromechanical actuators and have “human-level” hands.

“There's still a lot of work to be done to refine Optimus and prove it,” Mr Musk said.

Musk highlights the risks of robots and AI …

In 2017, despite his own efforts to further the use of technology such as AI and robots, Mr Musk sounded a warning.

“I have access to the very most cutting-edge AI, and I think people should be really concerned about it,” he said. Mr Musk went on to say it is “the biggest risk we face as a civilisation”.

“AI is a fundamental risk to the existence of human civilisation, in a way that car accidents, aircraft crashes, faulty drugs, or bad food were not,” he said.

Optimus has its sceptics …

It does, yes, mainly because robots in general have trouble with unpredictable situations — much like self-driving cars.

“Self-driving cars weren't really proved to be as easy as anyone thought. And it's the same way with humanoid robots to some extent,” Shaun Azimi, the lead of Nasa's Dexterous Robotics Team, told Reuters.

“If something unexpected happens, being flexible and robust to those kinds of changes is very difficult.”

For Tesla to succeed, it needs to show robots doing many unscripted actions, said Nancy Cooke, a professor in human systems engineering at Arizona State University.

“If he just gets the robot to walk around, or he gets the robots to dance, that's already been done. That's not that impressive,” she said.

Henri Ben Amor, a robotics professor at Arizona State University, said Mr Musk's price target of $20,000 was a “good proposition” since current costs are about $100,000 for humanoid robots.

What else does Tesla have in the pipeline?

The company is also working on a vehicle known as the robotaxi, which is to be unveiled in next two years, with production expected to begin in 2024.

“It is going to be highly optimised for autonomy — meaning it will not have a steering wheel or pedals,” Mr Musk said.

“There are a number of other innovations around it that I think are quite exciting, but it is fundamentally optimised to achieve the lowest fully considered cost per mile or kilometre when counting everything.”

Then there is the Cybertruck — a futuristic, angular, armoured-looking vehicle that is scheduled to enter production next year, bringing an end to a nearly three-year wait for early pre-production order holders.

The Tesla Semi, a battery-powered lorry, was unveiled in 2017 and is due to go into production next year. Reservations can be made on the company website.