Cryptocurrencies can help developing economies bridge the digital divide and boost financial inclusion, billionaire blockchain technology pioneer Brock Pierce said.

Citing El Salvador, which became the first economy to adopt Bitcoin as a legal tender last month, Mr Pierce said more than half the Central American nation's population downloaded the Bitcoin Wallet in a month.

“Results are unbelievable … they managed to achieve what was my highest expectation. The data shows the courageous move has worked … the latest technologies or innovations can address the global problem of under- or unbanked population,” Mr Pierce told a panel at a future-of-finance event hosted by the Middle East Futures forum this week.

“The level of interest in digital currencies in the developing world is unbelievable … how can you expect prosperity if you don’t have the essential financial tools? El Salvador has proved that this idea works to create financial inclusion,” he added.

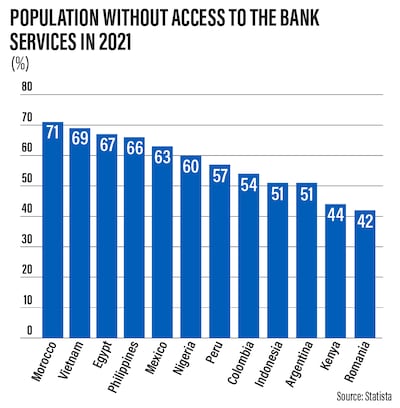

Globally, about 1.7 billion adults remain unbanked with no account at a financial institution or through a mobile money provider, a World Bank report released in 2017 showed.

Nearly half of them live in seven developing economies — Bangladesh, China, India, Indonesia, Mexico, Nigeria and Pakistan — and almost 56 per cent of all unbanked adults are women.

However, financial access rates have increased since 2011, when the Bank Group began documenting them through the Global Findex database.

The share of adults who own a bank account rose globally from 51 per cent in 2011 to 69 per cent in 2017 — an additional 515 million people, World Bank data show.

To attract people to digital currencies, the Salvadoran government offered citizens $30 worth of free Bitcoin if they downloaded the crypto wallet.

Mr Pierce said El Salvador’s move could face some initial hurdles including technological glitches, protests and less funding from agencies like the World Bank or the International Monetary Fund.

But it will attract new foreign direct investment worth billions of dollars to El Salvador, where more than 70 per cent of people are either unbanked or underbanked, he said.

“El Salvador does not get much money from the World Bank and IMF as compared to the other countries … I think they were expecting $1.3 billion this year in the form of debt.”

“But their recent action is astounding … very entrepreneurial, and it will attract FDIs that will create sustainable streams of revenue in the longer run,” he added.

Mr Pierce, who ran as an independent candidate for the US presidency last year, is chairman of the Bitcoin Foundation and co-founder of EOS Alliance, Block.one, Blockchain Capital, Tether and Mastercoin, and is credited with establishing marketplaces for digital currency.

“This [blockchain and digital currency] technology works in an environment where most people are unbanked or they don’t have access to their capital as in the case of Lebanon,” Ali El Husseini, chief executive of Medici Land Governance, told the panel.

“We have figured out that this is something revolutionary … makes things easier and will allow people to do things differently. It is really something that every country should adopt,” Mr El Husseini said.

Central banks around the world have been reluctant to endorse cryptocurrencies because of their speculative nature, lack of value and regulatory oversight.

The Central Bank of the UAE does not recognise cryptocurrencies as a legal tender.

Last month, China, the world’s second-largest economy, vowed to root out “illegal” activity in the trading of Bitcoin and other virtual currencies, as it renewed its tough talk on cryptocurrencies.