Start-ups in Saudi Arabia recorded a sharp increase in funding last year, as the kingdom continues to attract more companies to set up their regional headquarters.

Investment in the country's start-ups, including debt financing deals, increased by 160 per cent, while debt-free investment rose by 47.7 per cent, start-up data platform Wamda said in a report.

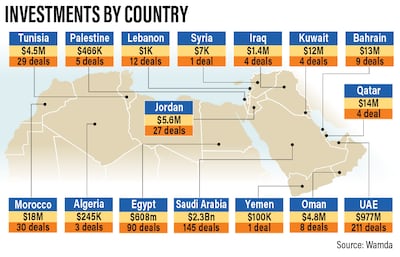

In total, start-ups in the kingdom raised $2.3 billion from 145 deals last year.

“Government efforts to ease regulations and build an attractive start-up hub in Riyadh are paying off, with an increasing number of start-ups from across the region relocating their headquarters to Saudi Arabia, in a bid to gain access to capital and the region’s largest market,” the report said.

Saudi Arabia's regulation requiring foreign companies to set up regional headquarters in the kingdom or risk losing out on government contracts came into effect this year.

While companies with foreign operations not exceeding 1 million Saudi riyals ($266,000) can operate in the kingdom without local headquarters, the regulation does grant benefits, such as tax exemptions, to those based in the country.

The kingdom is also heavily investing in start-ups as part of its Vision 2030 agenda to diversify its economy away from oil.

While the UAE has historically accounted for the majority of the Mena region's so-called mega deals – those with funding of more than $100 million – last year, start-ups from the kingdom accounted for four out of the five of such deals in the region, the Wamda report found.

They include Tamara (which raised $340 million), Tabby ($200 million), Floward ($156 million) and Nana ($133 million). FinTech platform Tabby moved its headquarters to Riyadh in November last year.

Egypt's MNT Halan, which raised $260 million, was the other mega deal recorded last year.

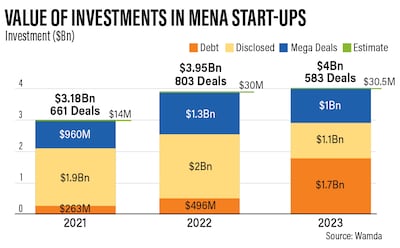

Overall, start-ups in the Mena region raised $4 billion in 2023, up 1.7 per cent annually, although half of the funding came from debt financing, the report said.

Outside of the $1.77 billion funded through debt, the total amount raised was $2.25 billion, a drop of about 35 per cent compared to 2022.

Among all the markets in the region, only Saudi Arabia, Morocco and Oman recorded investment growth, the report said.

The number of transactions regionally also dropped by 27 per cent, with the worst affected being Egypt, which saw deal volumes half year-on-year.

While the number of debt financing transactions dropped last year, the amount raised from debt increased by 256 per cent annually. When compared with 2021, the increase is “even more stark” at more than 570 per cent, the report said.

The most active markets in the region remain Saudi Arabia, the UAE and Egypt, which together accounted for 98 per cent of all the investment and 75.6 per cent of all transactions.

Start-ups in the UAE reported a drop in funding value and the number of deals last year, the report found.

Investment, including debt, decreased by 47 per cent to $977 million, which came from 211 deals.

While the drop is “dramatic and reflective of the region’s investors shifting their focus to Saudi Arabia, it is unlikely there will be an exodus of start-ups from the UAE”, the report said.

Investment in Egyptian start-ups dropped by 17 per cent annually last year to $608 million from 90 deals.

“Egypt has for many years been the powerhouse of new start-up ideas, but the country has been struggling ever since the outbreak of the war in Ukraine, on which it relies heavily on grain imports,” the report said.

“Since then its currency has been devalued, its economy has slowed and several of its start-ups have relocated their headquarters to Saudi Arabia.”

Looking ahead, there is “unlikely to be an uptick in investment activity in Egypt this year with investors becoming increasingly wary of the economic situation in the country”, it said.

FinTech continued to attract most of the funding in the region last year, accounting for 58 per cent of the total amount raised, including debt, at $2.3 billion from 112 deals.

However, the vast majority came from two buy now, pay later start-ups, Tabby and Tamara, that together raised more than $2 billion in debt and equity, accounting for about 51 per cent of the $4 billion raised last year

“Without the investment raised by BNPL start-ups, the amount invested in fintech amounted to just $286 million, a drop of 60 per cent year on year,” the report said.

FinTech was followed by super apps (raising $543 million from five deals), food technology ($222 million from 46 deals), e-commerce ($195 million from 42 deals) and logistics ($99.4 million from 31 deals).

Early-stage start-ups accounted for the majority of transactions, with seed-stage investments making up the bulk of deals.

The number of deals in the series C and above stages also increased, indicating “a sign of a maturing ecosystem”.

While the average ticket size also rose for these start-ups, those in series A and B saw a decline, “perhaps due to downrounds and falling valuations”, the report said.