With oil prices sinking below US$78 a barrel - down nearly 50 per cent from their historic high of $147 in July - GCC governments could be forced to start cancelling ambitious expansion plans. According to some estimates, oil prices have already fallen below the point where some regional oil exporters will start running a budget deficit. Kuwait, for instance, needs the price of a barrel of Kuwait Export Crude to stay above $75 a barrel in order not to run a budget deficit this year, according to Daniel Kaye, the senior economist at the National Bank of Kuwait. Yesterday, a barrel of Kuwait Export Crude fell below that point, to $68 a barrel. According to the Institute of International Finance (IIF), falling oil prices may soon cause budget deficits for both Bahrain and Oman. "If oil prices continue to fall, that's obviously going to affect the budgets in this region - and particularly as you get to this stage of the year, when governments start to plan their budget for the next year," Mr Kaye said. "Lower oil prices might lead them to temper any temptation to produce a really expansionary fiscal budget for next year, and that's likely to hit growth."

Admittedly, Kuwait's budgetary needs were artificially raised this year as a result of a huge transfer of 5.5 billion Kuwaiti dinars (Dh$75.37bn) to the country's social security fund. Without such exceptional transfers, Kuwait would be able to tolerate oil prices as low as $54 a barrel without breaking its budget. However, Mr Kaye said that there was a chance that a similar transfer would occur next year, keeping the required price of oil relatively high.

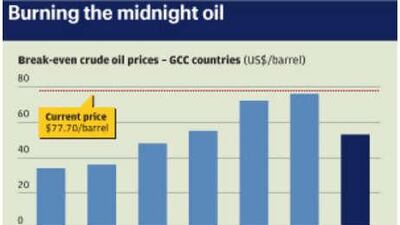

Nearly every Gulf government relies on oil exports for most of its income, and each of them has a number above which the oil price needs to stay in order not to run a national deficit. This price - called the "break-even oil price" - varies by country, according to the different economic dynamics of each. However, since accurate data for government spending are not available for all Gulf oil exporters, estimates of their break-even oil prices vary widely.

"Since no government tells you exactly what assumptions they are making for their spending, it's really a back-of-the-envelope kind of calculation," said Mandagolathur Raghu, the head of research at Markaz in Kuwait. Rachel Ziemba, an analyst at RGE Monitor, estimates that the UAE needs oil prices to stay above $45 or $50 a barrel for the government to balance its budget, whereas Mohammed Jaber, an economist at Morgan Stanley, puts the price lower, at $25 a barrel. Mohsin Khan, the director of Middle East and Central Asia at the International Monetary Fund (IMF), suggested an even lower price - $23 a barrel - according to Dow Jones last month.

Economists differ on which GCC economy is the most vulnerable to low oil prices. Mushtaq Khan, an economist at Citigroup, said it was Qatar, which requires $57 a barrel to balance its fiscal budget. Others, like the IIF, report that Bahrain and Oman have the highest break-even oil prices - about $72 and $76 a barrel respectively. Outside the GCC, the economies of other Gulf oil producers like Iran ($90) and Iraq ($110) are even more vulnerable to falling oil prices, according to Mohsin Khan.

If oil prices approach these levels, most economists agree that governments will probably have to stop increasing their spending at the current rate. In a region where government-backed infrastructure and property projects are keystones of national economies, a slowdown in government spending could have serious consequences. "If there is a concern that the oil price might continue to fall, I think there are a number of projects that might be scaled back - especially those that are still in planning phases or that have just been started," said Ms Ziemba.