Dubai recorded a 53 per cent annual growth in the value of real estate transactions in March to Dh34.2 billion ($9.3 billion) as the property market experiences resurgent demand amid a wider economic recovery.

The emirate recorded 12,000 real estate transactions last month, a 45 per cent annual increase in volume compared with 8,344 deals during the same time last year, according to a report by real estate listings website Property Finder.

A total of 9,000 sales transactions were registered in Dubai in February.

Off-plan transactions in Dubai accounted for 52.8 per cent of the total property sales in March and 36.8 per cent of the total value, the portal said.

Dubai recorded a 95 per cent annual growth in the volume of off-plan transactions, with 6,400 transactions recorded last month, compared with 3,287 in March 2022.

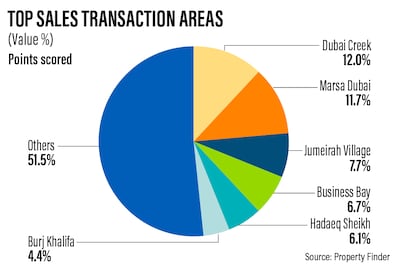

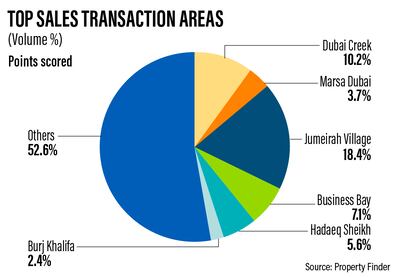

Dubai Creek Harbour accounted for 12 per cent of the total off-plan transaction value and 10 per cent of the total number of sales, while Dubai Marina represented 11.7 per cent of the sales value and only 3.7 per cent of sales.

Jumeirah Village Circle accounted for 18.4 per cent of the total sales in March, and only 7.7 per cent of the total transaction value.

“March 2023 has recorded an interesting spike in both demand and value for the UAE’s thriving property sector,” Scott Bond, UAE country manager at Property Finder, said.

“We have seen the emergence of new consumer preferences such as a growing incline towards ownership, with an equally sustained growth within the rental market.”

The UAE property market has continued to recover from the coronavirus pandemic on the back of government initiatives, higher oil prices and other measures to support the economy.

Property transactions in Dubai and Abu Dhabi surged last year amid higher demand from buyers.

The performance of the Dubai property market last year was described as "exceptional" by Crown Prince, Sheikh Hamdan bin Mohammed, as the value of deals reached a new high of Dh528 billion.

The value of transactions was up 76.5 per cent annually, while the number of transactions, at 122,658, rose 44.7 per cent year on year, a Dubai Media Office statement said in January.

Meanwhile, Dubai registered a 34 per cent annual growth in the value of secondary or ready property transactions to Dh21.6 billion last month from Dh16.1 billion in the corresponding period last year, Property Finder said.

The volume of secondary or ready properties also went up by 13 per cent annually, with more than 5,700 deals recorded.

This marked the highest volume and value for the month of March in a decade, Property Finder said.

About 60 per cent of people who desire to buy property in Dubai are looking for an apartment, while 40.3 per cent are interested in villas or townhouses.

In March, there was an increase in the share of investors or home seekers looking for apartments to 59.7 per cent, compared with 57.2 per cent last year.

Conversely, those searching for villas or townhouses decreased by 2.5 per cent to 40.3 per cent, from 42.8 per cent.

Among prospective home seekers, the most commonly searched apartment size was two bedrooms, accounting for 34 per cent of total searches, followed by one-bedroom apartments at 32 per cent, the data showed.

In the rental market, about 80 per cent of tenants search for apartments and 20 per cent look for villas or townhouses.

About 33.3 per cent of the tenants searched for one-bedroom apartments in March, followed by 30.4 per cent who prefer two-bedroom units, while 29.4 per cent were looking for studios.

For villas and townhouses, 42 per cent of tenants were primarily looking for three-bedroom units, while 35.5 per cent were searching for four-bedroom or larger options, Property Finder data showed.

The top-searched areas in March for rented apartments were Dubai Marina, Downtown Dubai, Business Bay, Palm Jumeirah and Jumeirah Village Circle.

Dubai Hills Estate, Palm Jumeirah, Arabian Ranches, Damac Hills and Mohammed Bin Rashid City were most preferred among those looking to own and rent villas or townhouses.