Property prices in Dubai increased by an average of 11.5 per cent annually in February as sales of residential units, primarily in the off-plan market, continued to rise.

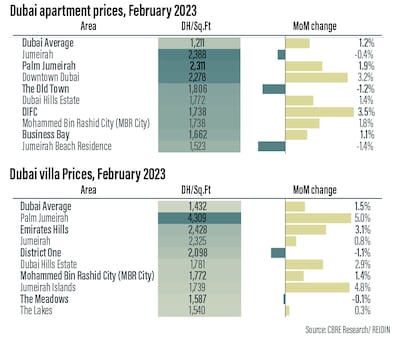

Average apartment prices rose by 11.2 per cent and average villa prices by 13.6 per cent in the year to February, to Dh1,211 ($329.7) per square foot and Dh1,432 per square foot, respectively, property consultancy CBRE said in its latest Dubai Residential Market Snapshot report.

Rates were also up on a monthly basis, with average apartment prices up 1.2 per cent and villa prices up 1.5 per cent.

Prices remain below the peaks registered in late 2014, with apartments down 18.6 per cent and villas lower by 0.9 per cent.

However, “several communities have already surpassed their 2014 figures”, CBRE said.

Jumeirah remains the most expensive area to buy in the apartment segment, with the price per square foot at Dh2,388, while for villas, The Palm Jumeirah registered the highest sales rate per square foot at Dh4,309, the CBRE report found.

Total transaction volumes in Dubai’s residential market during the month stood at 8,515, up nearly 44 per cent year on year and the highest February figure on record, the report said.

The growth was led by a 78 per cent increase in off-plan market sales, along with a rise of about 19 per cent in secondary market sales.

Overall, a record 17,741 residential transactions were recorded in the first two months of the year, the report said.

“In February, we have seen the strong start to the year, in demand terms, continue in Dubai’s residential market, with the total volume of transactions reaching the highest total recorded in the first two months of the year,” said Taimur Khan, head of research for the Mena region at CBRE.

“This record level of activity is supporting growth in average prices.”

Dubai's property market made a strong recovery from the coronavirus pandemic as the emirate's economy rebounded on higher oil prices and government policies, including changes to visa rules to attract more investment.

Last year, the value of property deals in the market reached a new high of Dh528 billion, up 76.5 per cent annually, while the number of transactions, at 122,658, rose 44.7 per cent annually.

The sector's “exceptional performance” will help Dubai to achieve its vision to be “one of the world’s top three cities”, Crown Prince Sheikh Hamdan bin Mohammed said in January.

“The results also support the goal of the Dubai Economic Agenda D33 … to double the size of Dubai's economy by 2033. The sector is a pillar of Dubai's strategy for sustainable development and a vital driver of its 2040 Urban Master Plan.”

Dubai remains one of the world's most attractive investment destinations because of its stable economy, strong financial fundamentals and ability to find opportunities for growth, Sheikh Hamdan said.

Chinese investors buying Dubai property — in pictures

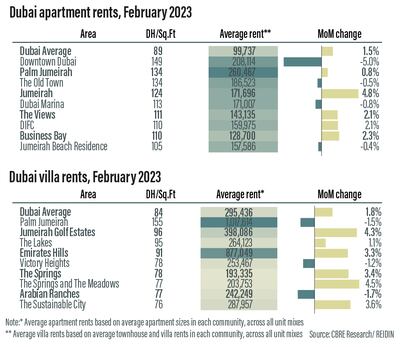

Meanwhile, average rents in the residential market have also continued to increase, growing 27.7 per cent in the year through to the end of February, CBRE said.

While apartment rents were up nearly 28 per cent, villa rents increased 26.3 per cent, the report found.

The average annual apartment and villa asking rents reached Dh99,737 and Dh295,436, respectively, as of February.

The highest rental rates for both apartments (Dh260,467) and villas (Dh1.01 million) were recorded in The Palm Jumeirah.

Rents have been rising due to an influx of high-net-worth individuals into the city, as well as the introduction of new visa programmes that encourage residents to stay longer or move from abroad.

“We have seen that tenants are more likely to renew their existing leases, where based on Ejari figures, the number of new registrations year on year in the year to date to February 2023 has decreased by 13 per cent, while the number of renewals has grown by 30.7 per cent,” Mr Khan said.