Mario Draghi will step down as European Central Bank president in October 2019, but speculation over his successor is already well under way.

Whoever gets the job has some big shoes to fill. The Italian’s eight-year term has been dominated by crisis-fighting measures and his defining pledge to do “whatever it takes” to preserve the euro. The next president, to be chosen by European Union governments, will likely have to unwind the ECB’s unprecedented stimulus and rebuild its buffers before the next downturn arrives.

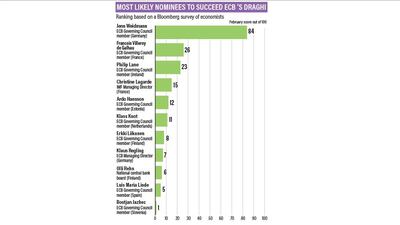

Germany’s Jens Weidmann is an early favourite, according to a Bloomberg survey this month, but there are plenty of others in the running. The appointment is just one of several top European policy positions coming up, setting the stage for plenty of political horse-trading over nationality and gender as well as expertise.

So who are the contenders?

Jens Weidmann

Mr Weidmann became the Bundesbank's youngest-ever president in 2011 after his predecessor resigned to protest ECB bond purchases. Now 49, he has taken a hard line against loose monetary policy, earning him respect at home but criticism from Mr Draghi for his perceived "nein zu allem"– no to everything – attitude. That may count against him if other nations fear he will be too hasty in shutting off the money taps. In his favour: Germany has never held the presidency despite being the region's biggest economy.

After studying in Germany and France, Mr Weidmann worked at the International Monetary Fund, and took a break from the Bundesbank from 2006 to 2011 to work as an adviser to German Chancellor Angela Merkel. He claims he builds his stamina by climbing the stairs to his 12th-floor office at the Bundesbank – a few kilometres uptown from the ECB.

Francois Villeroy de Galhau

France's central-bank governor is considered the top contender if governments balk at appointing a German. Since taking over at the Bank of France in 2015, Mr Villeroy has stuck close to Mr Draghi's line backing continued stimulus. Yet he's also a former banker with BNP Paribas, making him keenly aware of lenders' concerns over the ECB's negative interest rates.

It probably will not be much comfort to Germans, but he also has links with his neighbouring country. The 58-year-old scion of the Villeroy & Boch ceramics family hails from the border region of Alsace, and loves to address German audiences in their native tongue. French-speaking Mr Weidmann reciprocates.

Philip Lane

Ireland is the only founding member of the euro area that has never held a seat on the ECB's Executive Board, giving its central-bank governor some justification to take one of the four positions that will open up over the next two years. A former economics professor at Dublin's Trinity College, holding a doctorate from Harvard University, the 48-year-old has been an influential voice lately with his taskforce to design a safe European asset to protect against government debt crises.

While Mr Draghi's job is the top prize, the Irish government started its fight for a board seat this year by nominating Mr Lane for the vice presidency. He's also considered a contender to become the ECB's chief economist when Peter Praet steps down next year.

Christine Lagarde

Ms Lagarde made her name breaking tradition in a world of predominantly male economic policy makers. As French finance minister from 2007-2011, she was the first woman to hold such a post in a Group of 8 country, and since then has been the first female head of the IMF.

Ms Lagarde would also be the first woman to head the ECB and the first president without an economics degree. A trained lawyer, the 62-year-old would bring charisma and knack for quotes - she once said the Lehman Brothers crisis might not have happened if the bank had been Lehman Sisters.

Ardo Hansson

Chicago-born Mr Hansson, 59, has been one of the most-consistent critics of quantitative easing, arguing against rushing into bond-purchases in 2015 and in favour of signaling an exit to the crisis-era tool three years later.

A son of Estonian immigrants, with a doctorate in economics from Harvard, he was the World Bank's lead economist for China and one of the architects of Estonia's new currency after the collapse of the Soviet Union. His appointment would be a strong signal of recognition for the reform efforts made by the Baltic republics in joining the single currency.

________

Read more:

ECB QE programme has to end 'as soon as possible' says governing council

Euro strength may curtail quick ECB interest rate hike

________

Klaas Knot

The 50-year-old head of the Dutch central bank is one of the youngest members on the Governing Council. He's also typically on the same page as Mr Weidmann on the topic of monetary stimulus, speaking out against keeping asset purchases going for too long.

His seven-year term ends in June, and he's said he's "available" for a second round. Counting against him politically is the fact that the Netherlands has already held the ECB presidency - Wim Duisenberg was in charge for the single currency's first four years.

Erkki Liikanen

The 67-year-old Finnish central-bank governor would bring decades of Brussels experience to the top of the ECB as governments try to solve the single currency's structural shortcomings. In 2012, at the height of the debt crisis, he chaired a group of experts that outlined a plan of reforms for the EU banking sector. It has been only partially implemented.

Mr Liikanen was elected to Finland's parliament when he was only 21, and since then has held posts including European commissioner, finance minister, ambassador in Brussels and general secretary of the SDP. He was appointed governor of the central bank in 2004 and steps down this year. While he's a close confidante of Mr Draghi and has supported extraordinary stimulus, he's also considered moderate and pragmatic.

Klaus Regling

One of the architects of the euro, Mr Regling spent a decade at the German Finance Ministry where he helped prepare for economic and monetary union. In his current position leading the European Stability Mechanism, a backstop for countries in financial crisis, the 67-year-old has had close insight into the euro area's existential woes.

Mr Regling has held various positions in the public and private sector in Europe, Asia and the US, including at the IMF and the European Commission.

_______

Read more:

Gold nears four-month highs after hawkish ECB boosts euro

Sterling soars to highest level since Brexit vote

_______

Olli Rehn

Mr Rehn, 55, may be one of the newer faces in European central banking, but he's been involved in economic affairs for years. As EU commissioner in charge of the euro during the region's debt crisis, he was a strong advocate of fiscal discipline before returning to Finnish politics in 2015 as economy minister and overseeing the country's emergence from a three-year recession.

He was appointed to the board of the Bank of Finland in February last year, where he is widely expected to replace outgoing governor Mr Liikanen in 2018.

Luis Maria Linde

The Spaniard has more than two decades of experience at his country’s central bank, and has also worked at the economy and trade ministries. Now 72, he came out of retirement to lead the Banco de Espana in June 2012, two days after the Spanish government requested a bailout of the struggling banking sector.

Bostjan Jazbec

Slovenia's central bank governor, 47, helped guide his country through a banking crisis in 2013. He's still feeling the reverberations though - his office was raided by investigators in 2016, an action that was rebuked by ECB President Mario Draghi.

The former IMF adviser - and trumpet player - has stuck to the ECB's tune on monetary policy, saying stimulus should stay in place until inflation is back on track. He's also in line for a post on the Single Resolution Board, the institution that oversees the winding down of failing banks.