More people globally became millionaires for the first time in 2020 despite the economic damage caused by the Covid-19 pandemic, according to a new report by investment bank Credit Suisse.

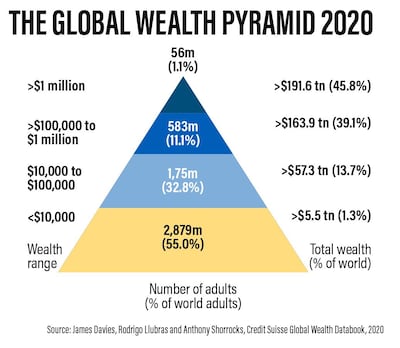

The global number of millionaires grew by 5.2 million to reach 56.1 million last year, marking for the first time in history that more than 1 per cent of all global adults are, in nominal terms, dollar millionaires. The uptick in wealth accumulation was driven by a rise in stock and housing prices, the Switzerland-based investment bank added.

"Wealth creation in 2020 was largely immune to the challenges facing the world due to actions taken by governments and central banks to mitigate the economic impact of Covid-19," Credit Suisse said in its Global Wealth 2021 report.

The Covid-19 pandemic pushed the global economy into its deepest recession since the 1930s. This prompted governments to inject a total of $16 trillion in fiscal stimulus last year, backed by $9tn in monetary support from central banks, to cushion their economies as businesses shuttered and millions lost their jobs.

“There is no denying actions taken by governments and central banks to organise massive income transfer programmes to support the individuals and businesses most adversely affected by the pandemic, and by lowering interest rates, have successfully averted a full-scale global crisis,” Nannette Hechler-Fayd’herbe, chief investment officer at Credit Suisse, said.

“Although successful, these interventions have come at a great cost. Public debt relative to gross domestic product has risen throughout the world by 20 percentage points or more in many countries,” she added.

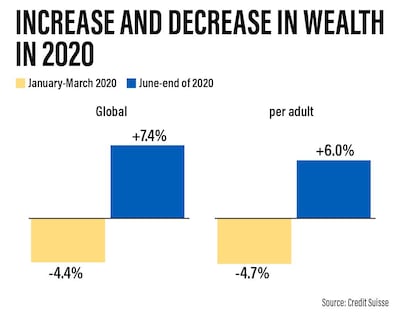

While the pandemic had a “profound short-term impact” on global markets in the first quarter of 2020, this had been largely reversed by the end of June, Anthony Shorrocks, an economist at Credit Suisse and the report’s author, said.

An estimated $17.5tn, or 4.4 per cent, was lost from total global household wealth between January and March 2020, the report said.

However, by the end of 2020, global wealth had increased by 7.4 per cent to reach $418.3tn. In terms of current US dollars, total wealth grew by 7.4 per cent and wealth per adult rose 6 per cent, the report said.

“Wealth creation in 2020 appears to have been completely detached from the economic woes resulting from Covid-19,” Mr Shorrocks said.

This was reflected in the rapid expansion of the world’s ultra-high-net-worth (UHNW) group, which grew even faster than the top 1 per cent, the report found.

The UHNW group added 24 per cent more members – the highest rate of increase since 2003, the report said.

“Since 2000, people with wealth in the range of $10,000 to $100,000 have seen the biggest rise in numbers, more than trebling in size from 507 million in 2000 to 1.7 billion in mid-2020,” it added.

“This reflects the growing prosperity of emerging economies, especially China, and the expansion of the middle class in the developing world.”

North America and Europe accounted for most of the world’s wealth gains in 2020. Total wealth rose 10 per cent to $136.3tn in North America, while in Europe it increased 9.8 per cent to $103.2tn, according to the report.

In China, total wealth grew 6 per cent to $74.8tn and the Asia-Pacific region (excluding China and India) added 6.7 per cent to reach $75.2tn. However, India’s total wealth dropped 4.4 per cent to $12.8tn and Latin America fell 10.1 per cent to $10.6tn.

“This loss was amplified by exchange rate depreciation; at fixed exchange rates, the loss would have been 2.1 per cent,” Credit Suisse said in the report. “Latin America appears to have been the worst performing region, with total wealth wealth [per adult] dropping by 11.4 per cent.”

Credit Suisse expects global wealth to rise by 39 per cent to reach $583tn by 2025.

Low and middle-income countries will drive 42 per cent of this growth, despite only accounting for 33 per cent of wealth today. The investment bank projects that wealth per adult will increase by 31 per cent to pass the $100,000 mark, while the number of global millionaires will reach 84 million by 2025.

"Coupled with restricted consumption, household saving has surged inflating household financial assets and lowering debts,” Ms Hechler-Fayd’herbe said.

“The lowering of interest rates by central banks has probably had the greatest impact. It is a major reason why share prices and house prices have flourished, and these translate directly into our valuations of household wealth.”