Almost everything about China stretches the imagination, a country of more than a billion people that has become the world's second-largest economy in a matter of decades.

China now makes 14.9 per cent of global gross domestic product, against less than 4 per cent in 1990, and sucks in more than half the world’s commodity exports.

Its economy was valued at $12.84 trillion in 2017, up from just $1.2tn at the start of the millennium, even if it still trails the US at $19.4tn.

Its stock market performance can also boggle the mind. In 2006, at the peak of the emerging markets hype, it grew 83 per cent, according to MSCI, then another 66 per cent in 2007. The next year, during the financial crisis, it fell 51 per cent, but last year grew 54 per cent. China does not do anything by halves.

Despite all these achievements, investors are starting to get edgy. Actually, that is not true, they have been edgy for years. We live in sceptical times and nobody quite believes the Chinese miracle can really be true.

As the economy slows and its debts pile up, many fear it could crash and take the global economy with it. No question about it, China is now too big to fail.

There are certainly reasons to be worried, with McKinsey Global Institute suggesting China’s debts have quadrupled since 2007. Its total debt is now about 234 per cent of gross GDP, the IMF says, a figure that could hit 300 per cent by 2022.

This has to end badly, doesn't it?

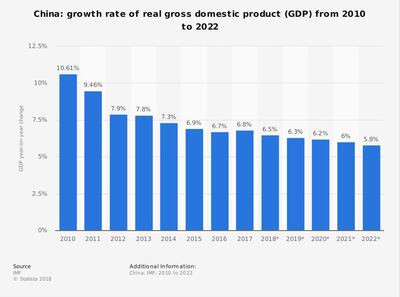

The economy is still rattling along, though, up at an annual rate of 6.7 per cent in the second quarter, a figure most of the developed world can only dream about.

True, that marked a dip from 6.8 per cent in the first quarter, with the domestic property market, factory output and export growth all slipping.

Craig Botham, emerging markets economist at Schroders, says China’s economy has also been squeezed by the government's crackdown on riskier lending, which has driven up corporate borrowing costs.

Like many, he is also sceptical about official figures. While GDP growth appears to be holding steady he is worried by "more violent perturbations of high-frequency data”, which suggests the economy may be decelerating at a faster pace.

Mr Botham says policymakers are working to offset the slowdown with more monetary and fiscal stimulus, but this will take time to come through. “We could see a recovery at the start of 2019, but by then growth will be facing headwinds from the building trade wars.”

Emiel van den Heiligenberg, head of asset allocation at Legal & General Asset Management, is also concerned about China’s financial stability, which is reflected in recent weakness in Chinese A-shares and its currency the yuan. “A Chinese economic hard landing or credit crisis is one of the biggest macro risks out there. As such, investors need to pay attention.”

President Xi Jinping is now prioritising stability over growth in his second term, shrinking the shadow banking system and slowing credit growth, which is triggering a rise in defaults, but he believes action now should safeguard the global economy.

The MSCI China Index fell 3.1 per cent in July and Hong Kong's Hang Seng dropped 11 per cent, and Andy Rothman, investment strategist at fund manager Matthews Asia, said anxiety is growing: "Chinese retail investors are nervous that government attempts to de-risk the financial system will stifle growth."

Yet corporate earnings remain firm and he says that “China is still the world’s best consumer story”.

President Donald Trump's increasingly aggressive trade war threats continue to worry stock markets but Mr Rothman is calm, believing the bilateral tariff dispute will be resolved in the autumn and even if it isn’t, investors should not panic. “If I’m wrong and it escalates into a real trade war, the impact on the Chinese economy will not be dramatic,” he adds.

Chris Beauchamp, chief market analyst at online trading platform IG, which has offices in Dubai, says markets are slowly becoming immune to Mr Trump’s trade war talk. “He recently turned the rhetoric all the way up to 11 with his announcement that $500 billion of Chinese goods could suffer penalties, but markets quickly recovered from their initial shock which suggests this kind of newsflash is starting to lose its power.”

Steven Downey, chartered financial analyst candidate at Holborn Assets in Dubai, says investors should not panic and retain their exposure to the Chinese economy. “Corporate profits tend to grow in line with GDP and China is still growing strongly, if you believe the public statistics.”

Many investors access China through a wider emerging markets mutual fund or exchange traded fund (ETF), to spread risk.

Vanguard FTSE Emerging Markets Index ETF is 36.4 per cent invested in China, far ahead of its second holding Taiwan at 14.6 per cent and India in third place at 11.1 per cent. Other popular ETFs include iShares China Large-Cap ETF, iShares MSCI China ETF and SPDR S&P China ETF.

Popular mutual funds include Matthews China Dividend Fund, Invesco Greater China Fund, and Fidelity China Region Fund.

Russ Mould, investment director at online trading platform AJ Bell, says investors should brace themselves for further volatility. “Doubts persist as to whether China really can grow at 6 to 7 per cent a year, if only because of the law of large numbers. Something that grows at 7 per cent every year for a decade doubles in size and that’s quite a feat, even for China.”

The authorities are trying to shift the economy from construction manufacturing and exports, to consumption and financial services. “This could take time and may lead to some lumps and bumps along the way. However, the ruling party's legitimacy rests on jobs and prosperity so it won’t want any slip-ups.”

__________

Read more:

Knowing when to sell a stock as key as knowing when to buy

Will higher US interest rates and the stronger dollar destroy the stock market?

The cheapest stock markets to invest in around the world

Get rich and retire early by investing like Warren Buffett

___________

Share performance is not always tied to economic growth, Mr Mould notes. "Big names such as Alibaba, Baidu and Tencent have all soared even while the Shanghai Composite index has been in the doldrums, while the technology sector is red hot, especially given China’s blossoming internet and e-commerce boom.”

The Chinese yuan is sliding in value, making now a cheaper entry point for overseas investors. “A cheaper currency could act as a shock absorber against US tariffs and also help boost exports."

Mr Mould says China is a complex case while investors should retain their exposure, they should also approach with caution. “China’s economy could continue to be very stop-start, as the authorities are likely to panic on signs of any slowdown.”

In the still unlikely event that China did crash, the consequences could also stretch the imagination.

Chinese equities come in from the cold

Outside investors have been wary of buying direct Chinese equities, preferring mutual funds and exchange traded funds (ETFs) instead.

However, Russ Mould, investment director at online trading platform AJ Bell, says the five biggest Chinese companies, Alibaba, Tencent, JD.com, YY and 58.com, are now too big to ignore.

All five offer exposure to booming Chinese demand for online products and services, in a land with a billion mobile phones. “Investors think these stock will also prove relatively immune to any slowdown in the broader economy or a trade dispute with the US.”

The top five are a play on China’s rapidly developing digital economy for investors seeking fast earnings growth and healthy capital gains.

Tech giant Tencent Holdings’s sprawling operations cover social media, mobile gaming, payment systems, web portals and its massively popular mobile chat service WeChat, and last year, its market cap burst through the $500 billion mark, briefly surpassing Facebook. Saxo Bank even suggested it could become the world's first $1 trillion company but recent earnings and margins disappointed and its cap has dipped to $409bn (as a comparison, the world's biggest company Apple is $1 trillion).

Alibaba Group Holding, which offers e-commerce, web portals, payment services and cloud computing, has overtaken Tencent with a market cap of $447.8bn, and Mr Mould says it is a genuine multinational with a presence in over 100 countries.

JD.com, with a market cap of $46bn, is a major e-commerce player that reportedly has the world’s largest drone delivery system, while online classifieds and listing platform 58.com has a market cap of $9.8bn, and video-based social network YY.com weighs in at around $4.65bn.

Mr Mould says all five can use their huge domestic market as a springboard to overseas success.

The Chinese stock market is not easy for overseas investors but all five firms now have overseas listings. “Alibaba and 58.com are traded on the New York Stock Exchange, JD.com and YY.com are on Nasdaq, while Tencent is listed on the Hong Kong Stock Exchange and also via American Depositary Receipts in the US.”

However, Mr Mould says that after posting stunning growth these stocks have become very expensive. “They are pricing in an awful lot of future growth, so they have some lofty expectations to meet.”

Mr Mould cautions that they operate in fast-moving, competitive markets where obsolescence is a key risk. "Very few technology firms stay at the