Towards the end of 2018, Suleman Soorani met the chief executive of Smart Crowd, a UAE real estate crowdfunding platform that allows investors to buy a piece of property for as little as Dh5,000. Mr Soorani, a director in a Dubai investments company, “loved the idea”, put in money in the start-up as an angel investor and then became a customer.

Property crowdfunding is a model where a group of people buy a single property asset and share the rental income. Mr Soorani invested a fraction of the price of a Dh500,000 Jumeirah Lakes Towers apartment listed on Smart Crowd, the first financially-regulated digital real estate investment platform in Mena.

“I wasn’t sure if the market had already bottomed out or if it was going to go down further, but I was OK with taking the risk [with a small amount],” says Mr Soorani, a 36-year-old Pakistani expatriate who has lived in Dubai for nine years.

The property price did decline further, but Mr Soorani still received dividends from the rental income with an average net yield of 6 to 7 per cent. He took advantage of low property prices to invest in another Smart Crowd property in Dubai Marina in mid-2019.

“If I had invested Dh500,000 and the property is down 20 per cent, I would have lost Dh100,000 in one property — I would have never invested in real estate again,” he says. “With Smart Crowd, with Dh300,000 I can buy 10 properties in 10 different locations, diversifying my risk.”

A recent study by Savills found Dubai witnessed the steepest fall in rents in a global index of prime properties due largely to oversupply, but the emirate still offers investors one of the most attractive rental yields in the world. Rents for the most exclusive properties in Dubai dropped 5 per cent last year, but gross residential yields remained the fourth-highest globally at 4.6 per cent.

Besides diversifying risk, real estate crowdfunding has other advantages: it is digital, hassle-free and allows access to an asset class that traditionally requires a large amount of capital upfront. UAE investors who cannot afford a hefty down payment or a burdensome mortgage can get in on the Dubai property market, as well as options further afield.

“In stocks you can buy one share, 10 shares, 50 shares, 100 shares, whatever you want … but in real estate the minimum denomination is so high that most people stay away from it,” Mr Soorani says. “The biggest advantage … is the ability to break down the large size of real estate investment into smaller denominations.”

How big is the real estate crowdfunding market?

Real estate crowdfunding platforms have become more popular in the last decade, mainly in the US and UK. For example, Washington company Fundrise, which launched its first online investment offering in 2012, has since invested in nearly $2 billion (Dh7.34bn) worth of real estate across the US and has 500,000 members. Its tag line? “Invest in million-dollar deals without writing million-dollar checks.”

Smart Crowd is relatively new in comparison. It was founded in 2017, obtained an innovation testing licence as part of the Dubai Financial Services Authority’s regulatory sandbox programme in April 2018 and received its full licence in October 2019. To date, it has over 2,000 accounts, around 200 active investors and Dh7 million in assets under management.

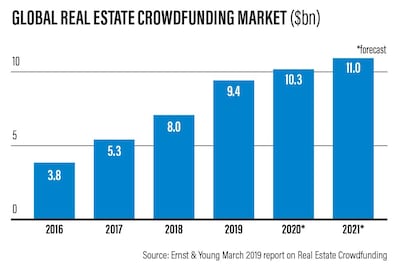

The total capital pledged to the global real estate crowdfunding industry was $8bn as of June 2018, including $6bn in the Americas, $1.3bn in Europe and $0.7bn in the rest of the world, according to a March 2019 report from Ernst & Young. It is projected to grow by a compound annual growth rate of around 23 per cent to $11bn in 2021.

How does real estate crowdfunding work?

There are two types of real estate crowdfunding platforms: lending and equity. There are also hybrid models that do both. The minimum amount of capital required to invest ranges from $100 up to $10,000.

Lending platforms act as intermediaries to match investors with third parties in need of loans to purchase a property. Investors expect to receive their money back plus interest over a period of time. Platforms using the lending model include Patch of Land, Sharestates and Groundfloor in the US, and The House Crowd in the UK.

The equity model allows a large number of investors to each purchase shares of a property. SmartCrowd, for example, creates a Special Purpose Vehicle (SPV) for each property, which is divided into one million shares and allocated proportionately to investment size. Other international equity platforms include Fundrise and CrowdStreet in the US, Property Partner and Yielders in the UK, and Crowd House in Switzerland.

Siddiq Farid, Smart Crowd’s chief executive, says the platform has stayed away from the lending model thus far, as it is a riskier proposition to push to retail investors. Returns are higher, between 8 per cent to 12 per cent, but "people just look at the returns, without necessarily understanding the level of risks they're taking to generate the return", he says.

How does Smart Crowd work?

Smart Crowd currently has 14 Dubai properties on its platform with an average of around 30 investors per property. Individual investments range from Dh5,000 to Dh125,000 and the average property price is Dh500,000. Mr Farid says a recent Dh1 million property garnered 70 buyers.

The costs to investors include a one-time 1.5 per cent fee, a 0.5 per cent annual administration fee, a 3 to 5 per cent property management fee on the rental income and a 2.5 per cent exit fee should they wish to sell. Mr Farid says, when compared to buying a property outright on your own, "the overall difference in the return over the same holding period would be 0.5 per cent to 1 per cent".

The advantage is "you won't have your money locked up in one property and … you will get to diversify your exposure" says Mr Farid. "So from a risk-adjusted basis, 7 per cent is better than 8 per cent."

The remaining cash is paid out either on a monthly or quarterly basis, and average annual net yields have ranged from 6.5 per cent to 9.7 per cent, says Mr Farid. Investors’ money is ring-fenced and held in the custodian bank, Emirates NBD.

“We try to eliminate as many risks as possible to the investor and only expose them to real estate risks,” says Mr Farid. “Prices can go up ... or down. Rents can go up ... or down. You’re returns might be impacted and that’s it.”

As with all real estate, investors will lose money if the difference between the exit value and invested capital is negative. Therefore, Mr Farid advocates holding property for the long term.

Smart Crowd goes through a rigorous 100-point screening process to select its properties and all are generating income. Apart from a couple of holiday homes in the portfolio, none have been empty longer than a week, Mr Farid says. Satisfaction from customers has led to a 65 per cent reinvestment rate and properties often sell out quickly.

Smart Crowd customer Steve Miranda, the director of finance and administration in a production company, invested Dh30,000 between five properties over the last several months. Mr Miranda, 47, says he is still “testing the waters”, but is happy with the ease of the process so far.

“If I buy a house, I have to look into maintaining it, all those other things. This, I just have to invest and everything else is taken care of. And you don’t have to spend a lot of money,” says Mr Miranda, who was born in the UAE. “It gives the common man the opportunity to own a piece of property in Dubai, which was never done before.”

Emirati Jumah Al-Mazrouie, 40, says he has also invested in several properties in Dubai through Smart Crowd because it's "easy to use", "cheap" and "it's safer because you don't put all your money in one place".

“Instead of saving money in a bank, I’m saving it in property,” says Mr Al-Mazrouie, a small-business owner.

What about international options?

Having just received its full license in October, Smart Crowd plans to launch international properties on the platform, including a UK property in the second quarter of this year.

Some real estate crowdfunding platforms are not available to international customers; Fundrise, for example, is only open to US residents. There are also tax implications to consider, depending on the country.

One option available to UAE residents is Brickowner, a relatively new player to the UK market. Founded in 2017 by Frederick Bristol, the eighth Marquess of Bristol, it has 2,800 users with 25 per cent coming from overseas and over £12m (Dh56.8m) in assets under management.

Brickowner gives people the opportunity to invest in UK property for as little as £100 "no matter where they are in the world", Mr Bristol tells The National. "We already have investors from the UAE and many countries in Europe."

The platform, which has partnered with Dubai-based real estate agency Tregoning Property to introduce UAE investors to Brickowner, has closed 15 to 18 properties and plans to offer three more in the coming months. The average investment per person is around £20,000, property prices range from £500,000 to £3m, and each property has between 50 to 120 investors, according to Mr Bristol. Brickowner has a reinvestment rate of over 60 per cent.

Rather than charging the investors fees, Brickowner charges the property developer between 3 to 5 per cent upfront and 0.75 per cent annually. It targets investor returns of over 8 per cent per year.

Mr Bristol sees crowdfunding as “the future of real estate investing” and Mr Farid of Smart Crowd agrees.

“You see real estate as being the most preferred asset class to invest, but the majority of the people don’t have the capital,” Mr Farid says. “This is the future of how people will access real estate from an investment perspective at least. We see a massive opportunity.”