UAE homeowners planning to switch a home loan to a lower interest rate could face unwelcome news, with many banks now charging a 3 per cent fee for early settlement, mortgage brokers are warning.

The fees for changing to another lender can amount to tens of thousands of dirhams and even higher for larger home loans, following a change in bank charges a year ago by the Central Bank of the UAE. For many borrowers the fee hikes nullify any cost advantage of shifting a home loan to another bank even when a lower rate is on offer, locking them in with their current bank.

"Once a client's fixed-rate period is over, they cannot shift their mortgage [economically] to any other bank which might be providing a competitive rate," says Haresh Lalwani, the managing direct at Right Move, a mortgage broker.

Before the fee amendment last year, early settlement fees were capped at 1 per cent or Dh10,000, whichever was lower. The new bank fees schedule - rolled out in June last year by the central bank - now caps the early settlement fee at a higher rate of 3 per cent or the actual cost for the bank, whichever is lower. With VAT added, that rises to 3.15 per cent.

"The cost applies to partial settlement charges based on the loan contract between the borrower and the respective bank," a Central Bank spokeswoman told The National via email. "However, the cost cannot exceed 3 per cent of the outstanding or the actual cost incurred by the bank towards partially closing the loan, whichever is lower."

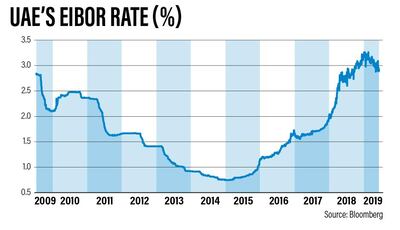

The change comes as the Eibor, which banks use as a base to set mortgage interest rates, is at its highest in nearly a decade, meaning that home owners with fixed-term mortgages that expire may face a spike in their monthly repayments. At the same time, rents are declining across the UAE, potentially putting additional pressure on leveraged property owners.

Some banks have notified customers about the changes by sending customers a text message alerting them that the terms and conditions have changed. Other financial institutions have updated the fees listed on their websites.

Some brokers claim banks that have implemented the new 3 per cent fee are automatically charging the maximum amount except in rare cases such as for very large loans or when there is an extensive banking relationship.

“Since the Central Bank has said that they can charge up to 3 per cent, everyone just jumped on to it and started charging 3 per cent, immaterial of what the actual charges amount to,” says one broker, who did not want to be named.

Banks listing an up-to 3 per cent charge for early settlement when transferring a mortgage to another bank include Mashreq Bank, RAKBank, Abu Dhabi Commercial Bank and Emirates NBD. The banks did not comment on their fees when contacted by The National.

At least three banks – Mashreq, ADCB and HSBC – list a flat 3 per cent fee with no reference to the bank's cost (Mashreq reduces to a 2 per cent flat fee after five years). HSBC has a fee of 3.15 per cent inclusive of VAT for borrowers who transfer their home loan to another bank within the first seven years, though early settlement from own funds or through sale of property has lower fees, according to a bank spokeswoman. "These fees are in line with the UAE Central Bank regulation issued in 2018," the spokeswoman told The National via email.

National Bank of Fujairah lists an early settlement fee “as per CB regulation”.

“We adopt a tiered approach based on the tenor of the loan and the relationship," says Colin Dallas, head of retail banking at NBF. "The parameters are reviewed periodically in line with market conditions. These rates are transparent and are communicated to the customer at the time of onboarding."

However, some banks still have the former 1 per cent charge in place, including First Abu Dhabi Bank and Commercial Bank of Dubai, according to the fee schedules on their respective websites.

For Pedro Silva, a Dubai pilot from Portugal, finding out about the higher fee came the hard way. When his fixed-term mortgage with Emirates NBD expired at the end of last year, his repayments jumped from Dh8,500 to Dh10,500 a month for a mortgage on a townhouse in Mira, Dubai, where he lives with his wife, a school nurse.

After failing to negotiate a new deal with his bank, he received an offer from another bank. The process took several weeks to sort the details, with Emirates NBD giving him a liability letter allowing him to transfer. He says he was then surprised to learn that the bank would charge him 3 per cent of the total loan to switch – amounting to almost Dh50,000.

Mr Silva says he received a short text message on February 11, stating: “Dear Customer, the schedule of Fees and Charges for your Emirates NBD Home Loan will be revised effective 15th Feb." The message came six weeks after he began the initial proceedings, he says.

Emirates NBD did not comment on the case.

Mr Silva says with the additional charge, shifting to another lender, even with an offer of 3.69 per cent, fixed for two years, was no longer cost-effective. Emirates NBD had offered him 4.5 per cent fixed for two years.

“I thought it was no brainer [to shift]. Only when I took it to the spreadsheet did I realise that it didn’t pay off, just for the sheer cost of the moving,” he says.

He ended up sticking with Emirates NBD and lodged a complaint with the Central Bank, via its consumer complaints portal on its website. The complaint has since been closed by the Central Bank because Mr Silva accepted the Emirates NBD mortgage offer.

Chris Schutrups, managing director at MortageFinder, part of PropertyFinder Group, says most bank contracts – if not all – will have a clause that allows for a bank to adjust their fees at any time. “My word of warning would be that the banks who haven't put [the 3 per cent fee] in yet could still do it later down the line. There’s no point in chasing after this, because it could become the standard across all banks.”

The change to the early settlement fee was made by the regulator in response to complaints from lenders that they were incurring high costs from people switching frequently, even in the first year of home loans, says Mr Lalwani.

The move in June last year was part of wider changes, many of which reduced the caps on fees that banks can charge, described in a press release by the Central Bank at the time as “a tool to protect consumers from anti-competitive and unfair practices”.

Along with property owners, some mortgage brokers say they are also affected by the changes. Previously, around one third of the business at Right Move was remortgaging work, which has now dried up, says Mr Lalwani. In one case, a client with a very large mortgage was quoted Dh240,000 as an early settlement charge – 24 times higher than the previous maximum amount a bank could charge.

Mr Schutrups says customers who find themselves being quoted high buy-out fees from their bank should in the first instance take professional advice, or try to negotiate directly with the bank. “You do have some options because the banks will negotiate. So if you're on a follow on rate, it is worth speaking to them to negotiate it to fixed,” he says.

Banks may also be willing to lower the 3 per cent amount for customers who have very large mortgages, or who have products such as banking, credit cards, or even a personal loan, says Mr Schutrups. “They are willing to move on that 3 per cent because they’re making money in other parts the business, whereas if you’ve just taken the cheapest rate, done nothing with the bank, and want to buy out, that's a different story.”

There is one way to get around the higher fees though, says Mr Schutrups.

For customers who settle their mortgage early with cash or by selling the property, many banks still have the old fee structure in place, with 1 per cent fee capped at Dh10,000. If a consumer is in a position to refinance another property, or they have cash, they can pay the mortgage off, incur the 1 per cent fee, and then take out a fresh mortgage to get around the 3 per cent, suggests the broker.

Those shopping for a new mortgage must read the fineprint of any mortgage contract carefully, says Mr Lalwani. “Go with a bank giving you more clarity in terms of all the rates and charges, and where everything is stipulated in the contract,” he adds.