If you are an avid stockmarket investor, it may come as a surprise to learn that your success (or lack of it) has nothing to do with the investment choices you make.

Indeed, some believe you have little say in it. The outcomes have no bearing on whether you use the most up-to-date technical analysis or the hottest share market tips. It isn't about timing the market, taking too much risk or staying out of the game.

Long-term success lies in none of these things - it lies wholly in your personality.

The Australian share pundit and writer Colin Nicholson believes that rather than predicting stocks that may or may not be successful, it is far better to predict how investment personalities will perform. This is the basis of his book, The Psychology of Investing. Investment decisions are in the DNA, he says. It is personality type - not investment choice - that determines results.

Investors do not have to look far to be sold brilliant shares or foolproof techniques. There are thousands of investment blogs where investors debate the dos and don'ts of the market on a minute-by-minute basis. Investment magazines engage expert tipsters armed with sure-fire hits for the year ahead, while there are many books on how to make your first million that can be bought from any respectable bookstore.

The point is not the shares or the amazingly convoluted techniques that may be promoted, but how the investors themselves react to circumstances.

It turns out that the stockmarket supremos we think we want to be - known as the "Type A", or aggressive alpha male investor - is exactly the investor we should never aspire to be. Nor should we ever have those types working for us.

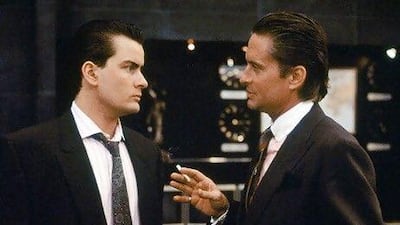

Classic examples are the infamous "Wolf of Wall Street", Jordon Belfort, or the mythical Bud Fox in the movie Wall Street. These are men we continue to fete for their ability to make a million dollars in a week, even if they tend to lose the same amount a week after.

Mr Belfort, the author of the bestseller The Wolf of Wall Street, had it all and lost it all. It's a classic rags to riches and back to rags again tale with sex, drugs and profligacy thrown in. Mr Belfort, shamefaced and contrite, is now trying to turn it all back into a riches story, using his own story as the sales pitch. Many are in awe of him and tend to forget he was controlling a firm that swindled investors out of US$200 million (Dh734.6m) in a shares fraud that landed him and his associates in prison.

People seem to aspire to Mr Belfort in spite of his disgrace. He now charges $200 for people to attend his lectures on how to go from zero to $100 million in no time flat. One attendee, an experienced stockbroker, listened to one of the seminars in disbelief. Mr Belfort's life story was the sales pitch and the purpose of the event was to upsell the audience - that is, buy a more expensive seminar, replete with Mr Belfort's best-kept secrets, for an extra $5,000.

"He was selling his way of selling. He was doing the very thing on us which got him into trouble in the first place. It was all air and hype," says the stockbroker, who does not want to be named.

We tend to look at the brash and confident as yardsticks for investment success, and the meek and mild as the losers. But Mr Nicholson says the relaxed and the docile are the most suited to investment success, while the overly aggressive are at a disadvantage.

Mr Nicholson brings the whole investment game to a confronting level. Are we ourselves suitable as investors? It is all about how you react to events and handle risk.

Marcus Padley, a stockbroker at Patersons Securities in Melbourne, Australia, and author of the share market newsletter Marcus Today, agrees that the alpha male broker has long been deemed an investment failure in stockbroker circles.

"All that shouting, swearing, phone slamming, rude, uncouth, belligerent, coarse, egotistical and crudeness is not, contrary to Hollywood generalisation, the sort of personality trait you want in a broker," says Mr Padley, who wrote about the topic recently in his column in The Sydney Morning Herald.

Mr Padley warns that in falling markets, the tendency is to believe that the investment landscape has changed and that investors have to be doing something differently. A lot of people, he says, have made the mistake of finding alpha by moving straight into highly leveraged derivatives. "Stick to what you're doing - but whatever you do, stay in for the long haul," he says.

The game is not to sell and disappear and never come back, he adds. It's OK to stay on the sidelines during volatility, but at some point, a tremendous low - such as those experienced in March 2003 and March 2009 - will occur.

"Hang on the sidelines and cheer every collapse," Mr Padley says. "Look for that low and come back in. But don't change your spots - we're being set up for a fantastic buying opportunity. It may not be today or in six months, but it's going to happen."

Are you psychologically suited to the share market? According to Mr Nicholson, you are if you are a patient long-term investor. Pleasant and patient people are the best investors, he says.

Even if there has been a major event, such as the global financial crisis or the current problems erupting in European debt markets, an investor would be better off retaining his or her pleasant and patient temperament throughout it, rather than attempting something completely radical and new.

Derivatives and highly leveraged instruments, such as contracts for difference, should be avoided when the markets are volatile.

People, says Mr Nicholson, come in three general temperaments, each with two extremes (unpleasant or pleasant, arousable or unarousable, submissive or dominant) and the eight various combinations of those three basic investors are exuberant, dependent, relaxed, docile, hostile, anxious, disdainful or bored.

It turns out the relaxed (pleasant, unarousable and dominant) and the docile (pleasant, unarousable and submissive) are the most suited to investment success and anyone with an unpleasant or arousable personality is to be avoided.

It sounds like the best person to invest with is the kind of man you'd be happy to walk into battle with, someone who, to paraphrase Rudyard Kipling, "can keep his head when all about him are losing theirs and blaming it on him".

Mr Padley agrees. "You want someone laid-back, reliable, emotionally stable, cool under pressure - someone with that Dunkirk spirit. Someone pleasant without being obsequious, agreeable without being subservient and decisive without being overbearing."