Put 20 per cent down when buying a home. Don’t spend more than 30 per cent of your income on housing costs. Keep childcare expenses below 10 per cent of your annual household income.

These money rules of thumb can be useful guides, helping you to allocate spending and determine what is affordable. They can also be incredibly defeating when they feel unattainable.

If money “rules” feel completely detached from your reality, know this: the average person often doesn’t come close to hitting many of the popular money rules. And that’s OK.

“If you treat ‘rules of thumb’ as rigid rules, you are setting yourself up for frustration,” says William O’Donnell, president of Heartland Financial Solutions in Nebraska.

“The thing people tend to forget is that guidelines are flexible because everybody’s situation is different.”

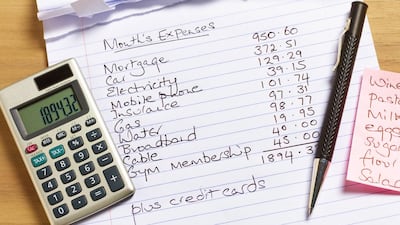

What is important is having a handle on your expenses and building a spending plan that works for you, not some ideal. Here is how to view money rules of thumb in the context of your own personal financial reality.

The rule: divide your budget into needs (50 per cent), wants (30 per cent) and savings (20 per cent).

The reality: housing alone can easily eat up half of your salary.

The 50:30:20 rule is a popular budgeting framework that divvies up income into three buckets: needs, wants and savings. But must-pay expenses can bust that budget before you even start.

In 2020, for example, 23 per cent of American tenants spent half or more of their income on rent alone, according to the most recent data available from the US Census Bureau. Add in other needs — utilities, groceries, transport, insurance, childcare and debt payments — and there is little, if anything, left over for wants or savings.

Don’t scrap your budget if the buckets don’t work. Instead, embrace the principle and adjust the framework to fit your current financial situation, with an eye towards where you would like to be long term. Sure, it may be more of an 85:10:5 budget now, but over time you can move closer to your ideal balance.

Simply tracking all of your expenses is a good start; you will see where every dollar is going and can make more informed decisions about your spending.

The rule: don’t spend more than 7 per cent of your household income on childcare.

The reality: many families spend 20 per cent or more on childcare.

The US Department of Health and Human Services considers spending more than 7 per cent of your annual household income on childcare unaffordable.

But a whopping 51 per cent of parents spend more than 20 per cent, according to a 2022 survey from Care.com, which interviewed more than 3,000 parents paying for childcare.

president of Heartland Financial Solutions

There are few things you can do to dramatically cut childcare costs, but discounts and scholarships may be available, depending on where you live and your childcare situation.

The rule: you need a 20 per cent down payment to buy a house.

The reality: First-time homebuyers typically put around 7 per cent down, according to data from the US National Association of Realtors.

The 20 per cent down payment “rule” is an outdated one, says Jessica Lautz, vice president of demographics and behavioural insights at the National Association of Realtors.

However, putting in more money upfront lowers the monthly and overall cost of your mortgage, but emptying your savings to buy a home can leave you on shaky financial ground.

Roughly 30 per cent of homeowners no longer felt financially secure after purchasing their current home, according to a 2020 survey conducted by The Harris Poll for NerdWallet.

That feeling was most acute among younger homeowners, with 42 per cent of millennial and 54 per cent of Generation Z homeowners feeling financially insecure after purchasing their home, compared with 31 per cent of Generation X and 16 per cent of baby boomer homeowners.

A mortgage broker can run the numbers to help you figure out the sweet spot for your down payment, but you also need to ask yourself a few questions, Ms Lautz says.

“Do you need money in savings to remodel once you are in the home, or backup savings for other expenses?” she says.

“Would a lower monthly mortgage payment be easier for other monthly expenses such as student debt or childcare?”