The next time you fly, the odds are that your ride is a rental – the sharing economy is literally taking flight.

About 40 per cent of the world’s planes are leased by airlines and it is a growing trend, especially in the Middle East where that ratio stands at about 30 per cent, according to aviation experts

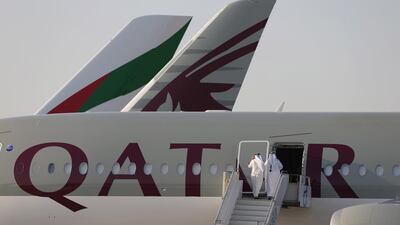

As tourism and business trips grow, airlines are beefing up fleet – especially the younger carriers of the Middle East such as Etihad, Emirates and Qatar Airlines. Regional airlines’ plane orders will exceed US$700 billion in value over the next 20 years, spurred on by the growth of transport hubs, regional economic and population growth, according to analysts.

But there is often a time lag between an order and delivery, meaning airlines can find themselves without planes to meet demand for new routes – and that means they must rent planes.

By leasing, an airline can also diversify its risks because, after a 10 year lease, an aeroplane may lose value, especially if newer, better ones have come on the market.

“Operating lease gives carriers a number of advantages,” says Kieran Corr, the Dublin-based head of aviation finance and the chief executive of Standard Chartered in Dublin.

“It increases the fleet’s flexibility,” he says. “If the airline decides to open up a new market or, at short notice, needs extra capacity it can go to a leasing company.

“When an airline orders an aircraft, there’s a long lead time until delivery. So an operating lease allows an airline to respond to near-term opportunities.”

That the countries of the Middle East are fast growing is giving a boost to the aircraft leasing business and providing rich pickings for lessors, as are other emerging markets such as China and India, according to Vasgen Edwards, the global head of aerospace and transport at the National Bank of Abu Dhabi. He cites India as a country with burgeoning airlines.

The Middle East economy is expected to grow at about 6 per cent a year over the next 20 years, outpacing the global rate, according to Mr Corr. A lot of that is being driven by the exponential growth of the regional hubs of Dubai, Abu Dhabi and Doha. As well as capitalising on Middle East travel, the region’s airports have also been taking market share from the transit links of Singapore and Bangkok for routes to Australia. The rise of low-cost carriers such as Air Arabia and flydubai is also helping the growth of the regional aviation business.

The real game changer Down Under came last year when Emirates tied up with Qantas, Australia’s biggest airline, taking a sizeable chunk of business away from Singapore. The rise of Arabian Gulf carriers has also left their competitors in Europe, the United States and Asia struggling to make money as the “Big Three” compete on pricing and lure customers with newer fleets.

None of the main airlines in the UAE were available to discuss aircraft leasing.

As well as a growing economy in the Middle East, airlines are also set to benefit financially from lower oil prices. Airline earnings are forecast to advance 10 per cent to a record US$36.3 billion in 2016, aided by cheap fuel and an expanding US economy, the International Air Transport Association says.

Banks in this country are also benefiting from the leasing trend as, in addition to financing the purchases of aircraft, they are also financing leasing companies that buy the planes. This is especially welcome for banks at a time when their traditional business making vanilla loans is under strain from lower oil prices. Emirates sold about $1bn in Islamic bonds in the first quarter of this year, an issue that NBAD participated in. Lenders are also funding leasing companies because many banks do not feel comfortable giving money to start-up airlines.

“You have a lot of young airlines popping up in places like India,” says Mr Edwards. “When you are a start-up airline, it’s not easy to go to a bank for $100 million for two aircraft – the bank will look at you and say you have no trading record.”

Mr Edwards says it is not inconceivable that a hub for lessors could flourish in the Middle East as it has in Dublin.

Waha Capital, an Abu Dhabi investment company, is one company that has bet correctly on the growth of aircraft leasing, with its stake in AerCap, a New York-listed Dutch aviation leasing firm. In December 2013, AerCap agreed to buy the insurer American International Group’s (AIG) aircraft leasing business in a $5bn plus deal. Under the terms of the transaction, which will increase the size of AerCap’s fleet to more than 1,300 aircraft, AIG received $3bn in cash in addition to 97.5 million AerCap shares for its wholly-owned subsidiary International Lease Finance Corporation. AerCap, in which Waha Capital has a 13.6 per cent stake, last month posted a drop in third-quarter earnings to $272.8m, from $353m in the same period last year, according to Bloomberg data.

Still, investors including hedge funds such as Greenlight Capital remain bullish about the long-term growth of the company.

David Einhorn, the chief executive of Greenlight Capital, said this year that he was counting on the company’s shareholder-friendly management and growing fleet of planes. He reckons the company will increase its earnings per share by 10 per cent a year.

mkassem@thenational.ae