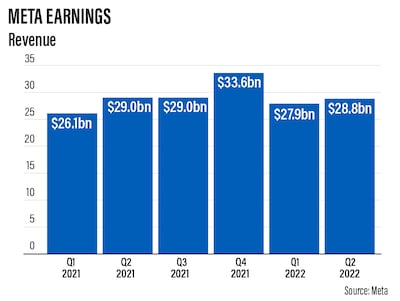

Meta, the parent company of Facebook and Instagram, said second-quarter net profit plunged 36 per cent year-on-year as it recorded its first quarterly revenue decline, underpinned by a decrease in advertising and rising competition from TikTok.

Net profit for the three-month period to the end of June fell to about $6.7 billion from the same period a year earlier. Net profit was down about 9.5 per cent from the first-quarter this year.

The social media giant's revenue dropped nearly 1 per cent annually to more than $28.8bn in the second-quarter, missing analysts’ estimates of $28.9bn. It was nearly 3.2 per cent up on a quarterly basis.

Shares of Meta, which have declined almost 50 per cent since the start of the year, gained about 7 per cent to $169.58 a share at the close of trading on Wednesday. However, they fell nearly 5 per cent in after hours trading.

The platform's number of daily active users grew 3 per cent yearly to reach nearly 2 billion in the last quarter. Its monthly active users increased 1 per cent to more than 2.9 billion.

"It was good to see positive trajectory on our engagement trends this quarter coming from products like Reels and our investments in AI," Meta founder and chief executive Mark Zuckerberg said.

"We are putting increased energy and focus around our key company priorities that unlock both near and long-term opportunities for Meta, and the people and businesses that use our services," Mr Zuckerberg said.

In the last quarter, advertisement impressions delivered across Meta’s family of apps increased by 15 per cent a year and the average price for advertisements dropped by 14 per cent annually.

Meta’s apps include Facebook, Instagram, Messenger, WhatsApp and other services.

The company’s last quarter’s diluted earnings dropped 32 per cent to $2.46 a share, compared to the $2.59 expected by analysts, Refinitiv reported.

Advertising revenue, which dropped 1.5 per cent a year, added nearly $28.2bn to Meta’s overall revenue. It constituted nearly 98 per cent of the company’s total sales.

Revenue from other streams, including reality labs, rose 34.8 per cent on an annual basis to nearly $670m.

The company’s reality labs business, which include metaverse, augmented and virtual reality-related consumer hardware, software and content, recorded a $2.8bn loss in the second quarter.

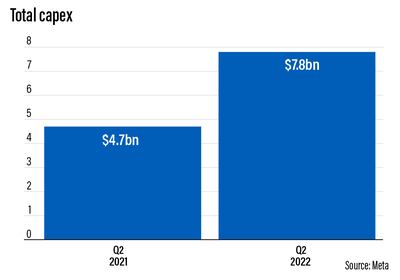

Meta’s capital expenditure, including principal payments on finance leases, in the second quarter was nearly $7.8bn. It is expected to be in the range of $30bn to $34bn for the 2022 full financial year.

The company, which employs 83,553 employees, repurchased $5.08bn of its common stock in the second quarter. It had more than $24.3bn available and authorised for repurchases as of June 30.

The cash and cash equivalents and marketable securities were $40.49bn as of June 30, a yearly drop of 36.8 per cent, the company said.

Meta expects 2022 financial year’s total expenses to be between $85bn and $88bn, lowered from its prior outlook of $87bn to $92bn.

The company said it reduced its hiring and overall expense growth plans this year to account for the more challenging operating environment.

It expects sales in its third quarter, ending on September 30, to be in the range of $26bn to $28.5bn, missing the $30.5bn average analyst estimate, Refinitiv said.

This outlook reflects a “continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty”, said Facebook’s chief financial officer, David Wehner.

“Our guidance assumes foreign currency will be an approximately 6 per cent headwind to year-over-year total revenue growth in the third quarter, based on current exchange rates,” Mr Wehner said.

The US dollar has increased about 10 per cent this year and the dollar index, which measures the greenback against six major currencies, hit a 20-year high this month.

“We continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations,” Mr Wehner said.

In a February report, the company threatened to pull Facebook and Instagram from Europe if it was unable to keep transferring user data back to the US amid negotiations between regulators to replace a scrapped privacy pact.

EU regulators have for months been stuck in negotiations with the US to replace a transatlantic data transfer pact on which thousands of companies relied.

It was struck down by the EU Court of Justice in 2020 over fears that citizens’ data was not safe when shipped to the US.