Franchising can be a successful and lower-risk model for expansion but small and medium food and beverage companies considering growth strategies should be aware of the challenges, an expert has warned.

The food and beverages franchise sector in the Mena region is expected to grow at 7.4 per cent annually over the next four years, according to Euromonitor International.

The sector grew 4.3 per cent last year and was worth US$79.1 billion, making the region the second-fastest growing in the world after Asia-Pacific. Within Mena, Dubai and Qatar beat that figure, growing at 5.3 and 6 per cent respectively, Euromonitor figures show.

Sary Hamway, the chief operating officer of networking group the World Franchise Centre, said that the franchising route may not be the best option for all businesses.

“Once you are a franchiser you have a second business to run as a manager and service provider,” said Mr Hamway.

“It requires more skills than you needed for the first business. Speedy expansion is not good for a new franchise. One should look at geographical clustering, close to your HQ, so you can offer logistical, managerial and technical support where and when it is needed, and then you need to offer more support than you do to your original outlets. Franchises fail all the time.”

Last year, UAE-based street food retailer Just Falafel was forced to scale back its ambitious target of 1,000 stores internationally by 2020 after some of its franchise outlets ran into difficulties. It has since revamped its menu and has stopped taking new franchise requests.

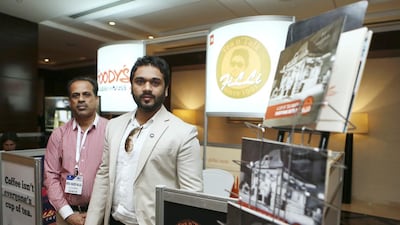

The local tea retailer Filli Cafe is planning to franchise as a less capital-intensive option for expansion plans to include opening 100 proprietary stores in the UAE and 500 franchised stores in India over the next 10 years, according to its founder.

“The franchise model makes sense to us because we need to expand but don’t necessarily have the capital required and the international experience for the expansion we plan,” said Rafih Filli.

“We have been trading since 1991 with our own manufacturing base in Assam.”

Filli Cafe, started in 2004, has 18 outlets in Dubai, one in Sharjah and sells more than 40,000 cups of tea every day.

Its business model focuses on stand-alone stores away from the malls, and selling cups of tea at Dh6 to Dh9. It will sell franchises for $20,000 over seven years and take a 6 per cent royalty on revenues with 2 per cent charged for marketing costs.

“The beauty of tea shops is the lack of theatricality and training that is needed for the vendor,” says Anselm Godinho, the managing director of International Conferences & Exhibitions, which runs Dubai’s International Coffee and Tea Festival.

“You don’t need a trained barista or a Dh50,000 machine. There are so many types of tea, 200 to 300 types, so the variety is a real crowd-pleaser. However, the UAE is a special case. How many other countries do you know that have a coffee pot on its currency? Coffee is more than a social occasion here, it is part of the country’s DNA – although more tea is drunk in this region than coffee.”

ascott@thenational.ae

Follow The National's Business section on Twitter