Every day the king of Arabic music greets me. He hangs around in my lounge, replete with pearly white teeth, smiling as he – Abdel Halim Hafiz – gazes into my eyes. Little wonder every woman in the Arab world swooned when he sang all those years ago.

For those not in the know, Abdel Hafez was the Arab world’s Elvis Presley.

Alas, he too is dead, but it is more than his memory that lives on for me. He is a constant reminder that each day we live is gone forever. Because he lives in my home in the form of a hand-painted poster – depicted as the hero in one of the movies he starred in – titled A Day of My Life.

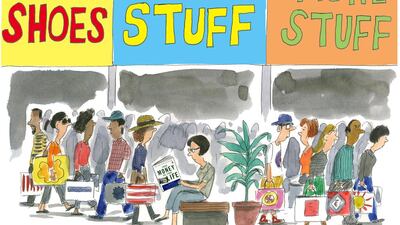

I rattle on about this because tomorrow is World Book Day. And the book I would like to be reading is the latest edition of Your Money or Your Life. It promises to redefine our relationship with both – money and life.

Both the book and the ‘60s poster nudge me to remember that time is our most valuable asset.

The authors, credited as the founding fathers of the financial independence movement, extol this: achieve a degree of financial independence that allows you to spend your time doing what is fulfilling for you. They did it. The book shares how.

The aim of the authors – Joe Dominguez and Vicki Robin – is to achieve financial intelligence and financial integrity, as well as financial independence. Bringing into focus how our financial life sits in relation to the rest of our life. In its simplest form, this involves figuring out what we spend our money on, then whether it adds to the quality of our lives, moving on to realising that our relationship with money involves more than earning, spending, debts and savings; it also includes the time these functions take in our life.

Nirvana is achieving “financial integrity”; understanding the true impact of our economic interactions, and having that impact reflect our true intentions.

It’s a consciousness system of living – with decisions around what is really valuable to you. That there is something greater than consumerism.

It is about the sustainable development of each of us.

This from the summary of the book: financial independence has nothing to do with rich. Financial independence is the experience of having enough – and then some. The old notion of financial independence as being rich forever is not achievable. Enough is. Enough for you may be different from enough from you neighbour – but it will be a figure that is real for you and within your reach.

A frequent conundrum I’m presented with is that it’s “impossible” for the person seeking my counsel to spend any less – and still live.

Vicki Robin states that everyone who participated in their Your Money or Your Life workshops (that started decades ago, before she and her late partner, Joe Dominguez, wrote the first edition of the book) – reported a 20 to 25 per cent reduction in expenses, and that the quality of their lives improved.

This isn’t an all-talk theoretical book. It has nine practical “how do I do it?” steps to achieving financial independence. Accuracy and accountability are vital.

In a nutshell:

1. How much money has come into your life and what do you have to show for it?

2. Being in the present: tracking your life energy.

3. Where is it all going: monthly tabulation.

4. Three questions that will transform your life (I thoroughly dislike this sort of "hook". The questions are valuable though – I especially like this one:

Would I be spending this if I didn’t have to work for a living?)

Respecting your life energy: maximising income.

Capital and the crossover point.

9. Securing your financial independence.

So many of us carry this around inside us: when do I get to be free? When do I get to find out what else is in me? What else do I want my body to experience?

You can find out if your investment-related income covers life’s expenses – achievable so much sooner if your “enough” is less.

Dominguez went the route of US treasury bonds which served him well. Times, and the investment climate, have changed since then. He retired at the age of 31 with US$70,000 and never earned from work again (yes, it was a very long time ago). His criteria for investment are:

• Your capital must produce income; your capital must be absolutely safe; your capital must be in totally liquid investment. you must be able to convert it into cash at a moment’s notice, to handle emergencies; your capital must not be diminished at the time of investment by unnecessary commissions, or other expenses; your income must be absolutely safe; your income must not fluctuate; you must know exactly what your income will be next month, next year and 20 years from now; your income must be payable to you, in cash, at regular intervals; your income must not be diminished by charges, management fees or redemption fees.

The investment must produce this regular, fixed known income without any further involvement or expense on your part. It must not require maintenance, management, geographic presence or attention due to “acts of God”.

The latest edition is not out – so I'll have to wait to find out what changed since Your Money or Your Life was first published – what hasn't changed though is that money equals the life hours we trade for it. That we are all profit or loss centres, and that fear of our financial future is real and is debilitating.

Abdel Halim Hafez was an activist in many ways – look him up. Now it is your turn. Go on. Be a time activist. Take back your time. Then ask: what do you want? What do you want your life to be? Financial independence gives you the option of finding out. Before your days run out.

Nima Abu Wardeh describes herself using three words: Person. Parent. Pupil. Each day she works out which one gets priority, sharing her journey on finding-nima.com

business@thenational.ae

Follow The National's Business section on Twitter