I can safely say that I am one of the most risk-averse people I know. Especially when it comes to my money and where I put it. One investment vehicle I've always steered well clear of is stocks. That world is just too volatile for me and that old-fashioned, risk-averse personality of mine.

And that's not only because it's the only place I know where your fortune can be wiped out in a matter of moments.

One day up, the next day down. Influenced by those irritating vagaries of sentiment, the global financial meltdown, the euro-zone crisis, poor economic data from everywhere USA, slower-than-expected growth in anywhere China. You name it, some element will always find a way to worm its way in and send global stock markets crashing to record lows. It's always been that way, unfortunately.

It's also a world where you'll find a lot of followers and very few leaders. If it wasn't for my risk-averse nature, that factor alone would be enough to keep me away. But, really, it's the worry and the stress of owning shares that, for me, make it just not worth it.

So you can imagine my surprise when I had a brainwave recently. Standing in the kitchen with the fridge door open, it came as such a shock that I sent a dozen eggs crashing to the floor. Seriously.

I blame Facebook for that, as well as a whole lot of other things, like failing to protect our privacy and that ridiculous Timeline. Specifically, though, I was thinking about Facebook and its initial public offering (IPO).

Look. I know. It's not in my nature. And owning shares has never been a part of my investment plan. Facebook's fundamentals should be enough to have me running in the opposite direction, not to mention memories of that nasty dot-com crash of 2000.

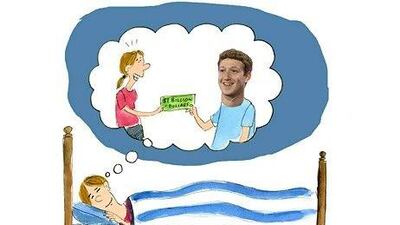

But the thought of getting in at the social-networking site's IPO level was just too, well, illuminating for me to let it go, not to mention the possibility of making a fast buck - which also happens to go against the grain for me.

So, as I mopped up the mess of the smashed eggs, a plan began to formulate.

But first, I had to figure out how small investors could get a slice of the action. So far, Facebook's IPO roadshow, which kicked off this month, has been targeting only institutional investors (think managed funds with big bucks) and retail investors (think the likes of Warren Buffett with even bigger bucks).

So perhaps I should be institutionalised for even having the temerity to think I could get in on a little Facebook IPO action.

Why? Well, the "mums and dads" investors - that's you and me - are being ignored. A slap in the face, really, when you consider it is these very people who are the majority of Facebook's nearly 900 million users. But that's Mark Zuckerberg for you; a socially inept nerd who seems to have forgotten how Facebook became so successful in such a short time, not to mention where the idea really came from. But shh. He doesn't like that being mentioned in public, despite the movie and the lawsuits from those pesky Winklevoss twins, who just won't let sleeping dogs lie.

I read on CNNMoney's website that mums and dads investors might be able to get a slice of Facebook's IPO through E*Trade, a US-based online trading site. There was my shot, I thought. But no, I have to be based in the US to set up an account with E*Trade. I also have to have a certain amount of money in the account and have made a certain amount of trades over the past year.

That rules me out then - and my plan to sell off the stock a few days after it listed, hoping to cash in on its popularity with the followers of this world.

But in the words of Mr Buffett, one of the world's most successful investors: "Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well."

No wonder he's called "The Sage of Omaha". I feel so much better already.