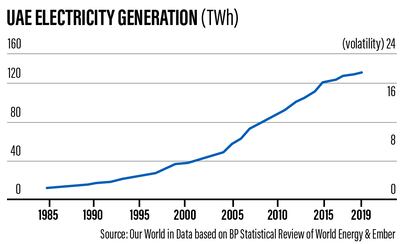

The UAE has come a long way from the time the first oil well was struck and crude became the country's most important commodity, bringing wealth and prosperity to its people.

Now, 50 years on, the country is looking ahead to the next half a century, where hydrocarbons will no longer be the mainstay of the world economy.

The UAE is innovating along with other regional and global producers to diversify its assets, improve efficiency, turn to renewables as an alternative source and grow into a world leader in developing hydrogen.

Oil and gas, however, remain critical to the development of the country, with Abu Dhabi National Oil Company, the state energy giant, continuing to invest in developing hydrocarbon resources.

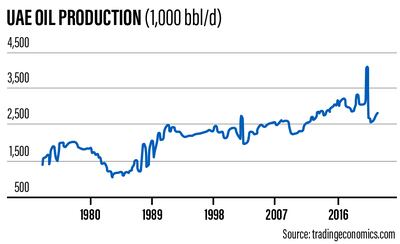

The UAE accounts for about 4 per cent of global oil production, with the bulk of the output from fields owned and managed by Adnoc. The country is also on track to raise its overall capacity of production to 5 million barrels per day by 2030.

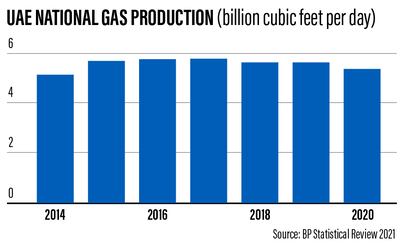

The emirates, which generates power from gas is also substantially increasing the volumes of the fuel, which is lower carbon to meet its growing consumption requirements.

The UAE, Opec's third-largest producer, consumes around 7.4 billion cubic feet (bcf/d) of gas per day largely to meet power demand, with the total share of imported fuel at 30 per cent, energy consultancy FGE estimates.

Abu Dhabi is prioritising the development of gas from unconventional reserves, which are deposits that were earlier considered commercially unviable to exploit.

The UAE announced the discovery of additional reserves of 7 billion “stock tank” barrels of oil, 58 trillion cf of conventional gas and 160tcf of unconventional gas in 2019.

This pushed the country up the rankings in terms of hydrocarbon reserves, data from the US Energy Information Administration showed.

Last year, the UAE also announced the discovery of 80tcf of shallow gas reserves in an area between Abu Dhabi and Dubai — the biggest discovery in 15 years.

Adnoc has also advanced more efficient production of oil and gas over the past five years, deploying big data and artificial intelligence to produce hydrocarbons more efficiently.

In February, Adnoc said it generated $1.1 billion in business value through the deployment of Big Data and analytics at its Thamama Centre, which oversees upstream operations. The company accrued $2bn in cost savings over the past five years by employing advanced technology and digitalisation to optimise its drilling operations.

The Thamama centre, which is named after the most dominant reservoir formation in Abu Dhabi, is part of the company's continuing investments in advanced technology, digitalisation and artificial intelligence, in order to drive greater efficiencies.

Adnoc has also formed a joint venture known as AIQ with Abu Dhabi artificial intelligence firm Group 42 to develop and commercialise AI products and applications for the oil and gas industry.

AIQ, Group 42 and the world's largest energy services firm, Schlumberger, also have an agreement to develop and sell AI products for the global exploration and production market.

The UAE also plans to find additional uses for crude to meet the growing global demand for chemicals, as well as to create a manufacturing hub in the country. The country plans to triple petrochemical production capacity from 4.5 million tonnes — currently produced entirely by the Borouge facility in Ruwais — by 2025.

Adnoc is also an early starter among regional energy companies in terms of opening up assets to foreign investment.

Even in the midst of the pandemic, Adnoc helped attract Dh62bn ($16.8bn) in foreign direct investment to the UAE this year, mainly through various multibillion dollar transactions signed in the midstream and infrastructure segments.

Between 2016 and 2020, the state-owned firm helped drive Dh237bn in FDI flows to the UAE.

At the height of the pandemic, a consortium of the world’s leading infrastructure and sovereign wealth funds signed an agreement worth $20.7bn to invest in Abu Dhabi’s natural gas pipelines infrastructure. The transaction, the largest single global energy infrastructure deal at the time and the Middle East's biggest, will unlock $10.1bn of foreign investment into the UAE.

Global Infrastructure Partners, Brookfield Asset Management, Singapore’s sovereign wealth fund GIC, Ontario Teachers’ Pension Plan Board, South Korea's NH Investment & Securities and Italy’s Snam took stakes in Adnoc’s lucrative midstream assets.

Adnoc also entered into a $5.5bn deal with Apollo Global Management to lease some of its properties, which led to a further FDI inflow of $2.7bn.

The UAE has continuously tried to position itself ahead of the curve and in many respects is a bellwether of changing regional market dynamics. It has embraced the energy transition by taking a leading position in new fuels such as green and blue hydrogen as it looks to tap the growing market for low-carbon fuel.

Following the latest edition of Abu Dhabi International Petroleum Exhibition and Conference, by The National's estimate, the week-long event resulted in more than $13.7bn of investment pledged to develop the UAE's upstream and downstream sectors. The figure takes into account only planned investments and awards by Adnoc, and does not include preliminary agreements by other companies.

The UAE in line with the global efforts to transition away from fossil fuels will also now host the 28th Conference of Parties in 2023 following its pledge this year to reach net zero by the middle of the century.

The country created history by becoming the first Arab nation to pledge to offset all carbon emissions it creates domestically ahead of Cop26.

As the country looks forward to a new age away from oil, Adnoc is also adding renewables to its portfolio.

Along with Taqa, a major player in utilities, Adnoc will form a joint venture to invest in renewables.

The companies joined forces to create a global renewable energy and green hydrogen venture that will have a generating capacity of 30 gigawatts by 2030.

The two companies will partner on domestic and international renewable energy and waste-to-energy projects, as well as the production, processing, and storage of green hydrogen.