Global remittances increased 7 per cent to $613 billion in 2017 from 2016 on the back of strong economic growth in Europe, the Russian Federation and the United States, according to the World Bank.

The bank noted however that the cost of sending $200 was 7.1 per cent in the first quarter of 2018, more than double the 3 per cent target set as a sustainable development target.

“While remittances are growing, countries, institutions and development agencies must continue to chip away at high costs of remitting so that families receive more of the money,” said Dilip Ratha, lead author of the world bank’s remittance report. “Eliminating exclusivity contracts to improve market competition and introducing more efficient technology are high priority issues.”

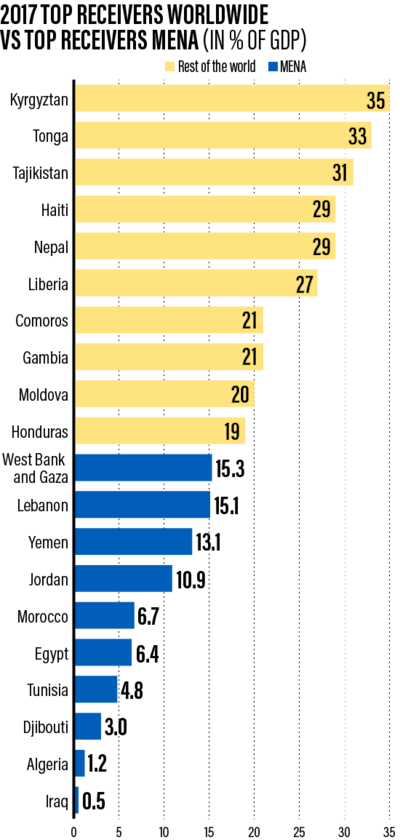

This is more urgent as the bulk of the money sent by workers back home goes to low and middle income countries, accounting for 35 per cent of GDP of some states. The growth of money sent back home by migrant workers to low and middle income countries saw even stronger growth in 2017 than the global tally, rising 8.5 per cent to $466bn compared to $429bn in 2016, the World Bank said.

__________

Read More:

Kuwait's proposed tax on remittances could hit the poorest members of society

Axis Bank targets higher remittances share as it opens Sharjah office

___________

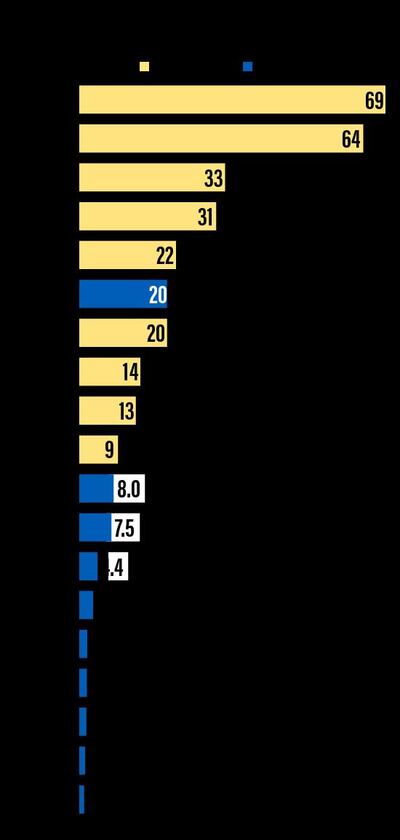

The top remittance recipients were India at $69bn, China with $64bn, the Philippines with $33bn, Mexico with $31bn, Nigeria with $22bn and Egypt with $20bn.

The report noted that sub-Saharan Africa, which boasts some of the poorest nations, have some of the world’s highest remittance cost and that the average cost of sending money is 9.4 per cent.

Exclusive partnerships between the national post office system and money transfer operators was the biggest barrier to lowering costs, according to the report.

The Middle East and North Africa saw the second biggest gain in remittances regionally speaking, with money sent back home increasing 9.3 per cent to $53bn in 2017. The biggest bulk of that money, $20bn, came from Egyptians where the steep devaluation of the Egyptian pound against the US dollar in November 2016 spurred Egyptians living abroad to pour back money into the country. Many had previously held back from doing so before the devaluation because the central bank of Egypt was using its foreign reserves to keep the pound’s value artificially high.

Money flowing out of the Arabian Gulf however may slow this year because the cost of living is increasing in the aftermath of subsidy cuts and VAT implementation earlier this year by Saudi Arabia and the UAE.