In India's financial capital, towering luxury residential skyscrapers overlook Mumbai's overcrowded dusty streets, where many families live without a roof over their head.

The country's government has been striving to bridge this glaring accommodation gap between the rich and poor, with an ambitious initiative that promises to ensure "housing for all" by 2022.

Developers and analysts say the scheme has had mixed results so far, but they believe the government remains firmly committed to support the affordable segment of the real estate market — at a time when the broader industry continues to struggle.

“It is true that not as many real estate developers have taken up projects in this segment as would have been expected by now,” says Niranjan Hiranandani, the national president of industry organisation NAREDCO and the managing director of Hiranandani Group, a Mumbai-based developer. “The good news is that more and more real estate developers are commencing work on projects of this segment. We are in a scenario where ideally, things should work out.”

Indian prime minister Narendra Modi launched his "housing for all" initiative four years ago, with two schemes unveiled so far to help achieve this ambition.

They are the Pradhan Mantri Awaas Yojana — Gramin, for the rural poor, aimed at building 10.2 million houses by 2019, and Pradhan Mantri Awaas Yojana — Urban, which targets 12 million new houses for the urban poor by 2022.

Progress is being made on these additional homes, although hitting these targets will be tough, data suggests.

In the latest Economic Survey, the flagship annual document of India's Ministry of Finance, it says the rural scheme has delivered 8.6 million completed homes, while only 3.2 million of the urban homes have been completed. However, a further 6.1 million have been approved and “grounded for construction” under the urban scheme.

“The PMAY Urban scheme is rapidly moving towards achieving the vision for providing a pucca house to every household by 2022,” according to the Economic Survey. It is “one of the largest housing schemes of the world covering complete urban India”, it adds.

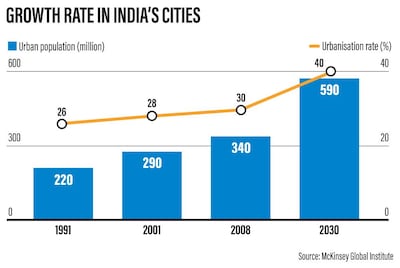

The survey said India's cities were the engine of its economic growth and the investment being made not only provided housing to eligible families but also triggered a "multiplier effect on the overall economy”.

The government's "aggressive push towards achieving its target of 'housing for all' by 2022 has yielded tangible on-ground results,” says Anuj Puri, the chairman of Anarock Property Consultants.

“The government’s most hyped scheme, PMAY Urban, is getting visible traction across all states,” he adds.

Mr Puri explains that in terms of the urban scheme, “timely construction remains a challenge, but the introduction of new and effective technologies such as prefabricated construction can help achieve this target within the stipulated deadline”.

Alongside this scheme targeted at the poor, private developers are also increasingly launching affordable homes for the middle class, who have struggled to afford properties in cities such as Mumbai.

This is a shift for an industry that has focused on targeting wealthier buyers.

“One of the significant aspects is the fact that real estate developers, private players in particular, have primarily targeted luxury, high-end and [the] upper-mid housing segment owing to the higher returns that can be gained from such projects,” says Ankur Jain, the chief executive of Group Satellite, a Mumbai-based developer.

“This has been one of the reasons for the shortfall in India’s affordable housing market. Traditionally, low-cost housing has been the domain of the government. High land costs, stringent licensing norms, delays in project approval and unfavourable banking policies made low-cost housing projects uneconomical for private developers.”

Group Satellite, which has been developing real estate since 1970, only moved into the affordable segment of the market in 2018.

Its project, located in the suburbs of Mumbai, contains 1,200 apartments of mainly small, one-bedroom units, which are priced at 4.85 million rupees (Dh248,970). The homes are aimed at “first time buyers, retired couples, aspirational young couples and people seeking budget homes”, says Mr Jain, adding that out of the 450 units being built in the first phase, 350 have already been sold.

He says the government has taken a series of steps to incentivise developers to build affordable homes and help buyers. These include offering subsidies on the interest applied to loans for affordable homes.

“What seems promising is the fact that certain announcements made by the government during the recently-concluded Union Budget 2020 will auger well for the affordable housing sector,” he says. “It is a welcome move to extend tax sops to affordable housing projects for another year as it is encouraging for developers of affordable housing projects. A revision in [the] personal income tax structure has equipped people with a better disposable income compared to the last budget. This would leave more disposable income in the hands of the middle class.”

Another company tapping opportunities in India's affordable housing sector is Planet Smart City, a London-headquartered company that designs and builds affordable housing. This month, it launched an advisory arm in the city of Pune and plans to work with real estate developers and government agencies to offer research and implementation expertise. It also has ambitions to eventually develop properties in India.

“It's well known that in India there's a housing deficit which is more than 30 million housing units,” says Daniele Russolillo, Planet Smart City's chief operating officer and deputy chief executive. “The demand for affordable housing is absolutely huge."

He acknowledges there is a slowdown in India's property market but adds that the government is actively trying to attract foreign investment into the country, which should be positive for the sector.

This is all the more important given current liquidity challenges. Many projects in India's property sector have stalled amid sluggish growth in the economy and a liquidity crunch in the non-banking financial sector, which has pushed a number of companies out of business.

“Cash investments from the outside would be something that's nicely accepted [by India],” says Mr Russolillo.

Analysts say there is more work to be done to attract more investment into the sector — be it from abroad or at home.

“Housing remains an unpalatable investment category for smaller, domestic investors,” says Mr Puri at Anarock. He describes the real estate sector as the “neglected stepchild” of the Indian government.

“Currently, India's housing sector is riding almost exclusively on end-user sales, which are not enough to revive residential real estate and its related benefits of furthering the 'housing for all' by the 2022 goal and generating increased employment,” he says.

“A convincing revival of the Indian real estate sector is essential for the economy to move out of its current slow phase and achieve the mammoth targets of housing for all by 2022 and make India a $5 trillion economy by 2025.”

Despite the expansion of the budget housing sector, developers also say there is still more to be done to encourage builders to focus on affordable housing.

“Making affordable housing a viable business model can motivate private real estate developers to participate actively and aggressively in this segment,” says Mr Jain.

India should therefore “incentivise private developers in the affordable housing segment by allowing them access to cheaper land, a reduction in the number and the time taken for approvals, assisting with infrastructure development, easier home loans and interest rate and tax subsidies”, he says.