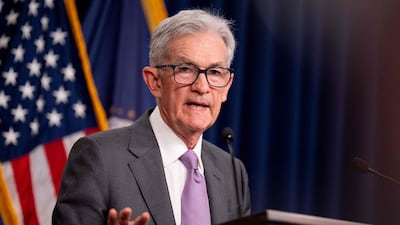

Federal Reserve chairman Jerome Powell on Wednesday said the US central bank could cut interest rates as soon as September, nearly completing the Fed's policy cycle after leaving rates unchanged for almost a year.

"We’re getting closer to the point at which it’ll be appropriate to reduce our policy rate, but we’re not quite at that point," he told reporters.

After leaving the Fed's target range between 5.25 and 5.50 per cent, Mr Powell acknowledged the “considerable progress” made in taming inflation, while also acknowledging the labour market is continuing to move into balance.

“The question will be whether the totality of the data, the evolving outlook in the balance of risks are consistent with rising confidence on inflation and maintaining a solid labour market,” said.

“If that test is met, the reduction in our policy rate could be on the table as soon as the next meeting."

Mr Powell also said there was a “broad sense” among other members on the Federal Open Market Committee to soon begin cutting rates.

“The decision was unanimous … but there is a real discussion back and forth, what the case would be for moving at this meeting,” he said.

Mr Powell appeared to acknowledge that there was some disagreement on when to cut interest rates, saying that a “strong majority” supported leaving them unchanged on Wednesday, rather than all members.

“We suspect today's decision, post-meeting statement and Powell's press conference statements reflect a compromise among the committee members,” Wells Fargo economists Sarah House and Michael Pugliese wrote in a note.

“To thread the needle, we think chair Powell arrived at a compromise: hold rates steady at this meeting, but send overt signals to the market and broader public that the base case is for rate cuts starting soon.”

Art Hogan, chief market strategist at B Riley Wealth, said a significant move like a rate cut could would require consensus among all policy-voting officials.

"I think that now what we'll hear is a very well choreographed message from the Fed speakers that can go back on the tour and talk about what they're thinking about monetary policy," Mr Hogan said.

"And I think that tone change will further solidify the fact that they're getting closer to feeling comfortable enough to pull the trigger here."

Traders have now virtually locked in a September rate cut, with about 84 per cent looking at a quarter-rate reduction, according to CME's FedWatch tool. About 16 per cent forecast a cut of 50 basis points.

"It was the Fed's game to lose, meaning pushing back against the consensus that there's a September rate cut would have been disappointing for the market, and not doing that ... was a victory for both the market and the Fed in terms of messaging," Mr Hogan said.

Should the Fed move to cut rates in September, the Central Bank of the UAE would be expected to follow as its currency is pegged to the dollar.

The UAE's central bank held interest rates steady at 5.40 per cent on Wednesday after the Fed's announcement.

Behind the Fed's shift towards rate cuts is a series of positive economic data from the second quarter, highlighted by moderating inflation.

Last week's Personal Consumption Expenditures Price Index highlighted the progress the Fed has made, with headline inflation coming in at 2.5 per cent.

The Fed has also seen positive developments in the labour market, as the unemployment rate has climbed to a still-healthy 4.1 per cent while job gains have moderated.

In its post-meeting statement, the Federal Open Market Committee acknowledged these two risks are continuing to move into better balance.

The Fed still finds itself in a delicate scenario, as Mr Powell acknowledged.

Cutting rates too soon could undo the progress the Fed has made on taming inflation, while waiting for too long could lead to a recession and a sharp increase in the unemployment rate.

Such a scenario has led some economists, including former New York Fed Governor Bill Dudley, to push for cutting interest rates now.

“Although it might already be too late to fend off a recession by cutting rates, dawdling now unnecessarily increases the risk,” Mr Dudley wrote for Bloomberg Opinion last week.