Live updates: Follow the latest news on Israel-Gaza

Global manufacturers and retailers of goods from clothes to cars face big risks from shipping disruptions in the Red Sea, where longer delays and surging freight costs could lead to higher consumer prices.

Sectors such as perishable products, electronics, machinery, textiles, apparel, retail, automotive parts and consumer goods will bear the biggest brunt from disruptions in shipping lanes connecting Asia, the Middle East and Europe, analysts say.

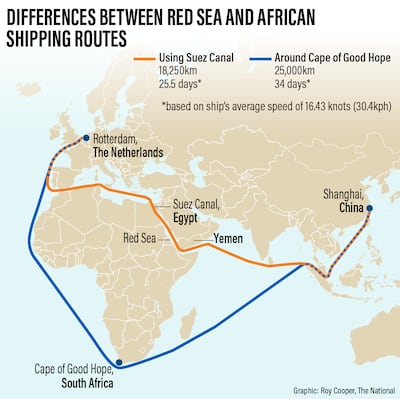

Commercial vessels are rerouting to avoid the Suez Canal amid rising security risks in the key trade lane, where Yemen's Houthi rebels began attacking commercial vessels in late November in what they said is a show of support for Palestinians affected by the Israel-Gaza war.

“The longer trade distances and higher freight rates could have cascading effects on food prices,” Jan Hoffmann, chief of the trade facilitation section at the UN Conference on Trade and Development (Unctad), said last week.

Nearly half of the increases seen since Russia's war in Ukraine were due to higher transport costs, he added.

“The disruptions in key global trade routes also affect energy prices and raise inflation risks,” Mr Hoffmann said.

The volume of trade going through the Suez Canal has decreased by 42 per cent over the past two months since Houthi attacks forced shipping companies to divert freight around the southern tip of Africa, Unctad said last week.

About 39 per cent fewer ships than at the start of December transited the canal, it said.

The Suez Canal handles between 12 per cent and 15 per cent of global trade, Unctad said. For container shipping, it is even more important as 20 per cent of the world's container trade goes through the waterway.

However, early data from 2024 shows that more than 300 container vessels, or 20 per cent of global container capacity, were diverting from or planning alternatives to the Suez Canal, according to Unctad.

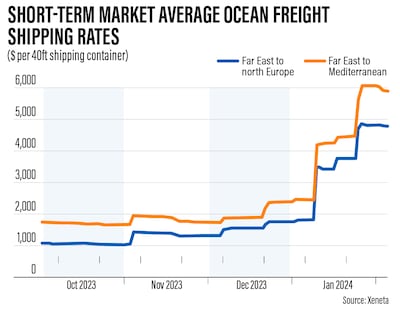

The cost of shipping goods through the Red Sea has risen steeply since the attacks. The surge in the average container spot freight rates during the last week of December – by more than $500 in one week – was the highest weekly increase on record, the UN body said.

The Red Sea crisis is compounded by the drought-hit Panama Canal, another key route for global trade. Last month’s total transits through the Panama Canal were 36 per cent lower than a year ago and 62 per cent lower than two years ago, Unctad said.

Global goods

“The goods most affected by the attacks are from the retail, automotive and energy industries, due to their seasonal or 'just in time' approach to shipping and manufacturing,” Matthias Menck, principal consultant at Proxima, told The National.

Major shipping players are opting to avoid the Suez Canal and taking an alternative route via the Cape of Good Hope in South Africa, which adds more than two weeks to the journey.

“This is going to lead to businesses facing delays in receiving stock, which will particularly impact businesses selling seasonal goods such as those in the fashion industry,” Mr Menck said.

“It will also have a knock-on impact across the year in terms of increasing lead times for imported goods, which will force businesses to bring forward decisions to ensure they are adequately stocked in key periods.”

Trade in perishable goods such as agricultural commodities and seafood will also be affected, with leaner margins in these businesses limiting companies' flexibility to absorb higher freight costs, Anuj Sethi, senior director at Crisil Ratings, told The National.

“Insurance costs have risen sharply and the impact of these cost increases would depend on a case-by-case scenario, which will determine the extent of price increase to be passed on to the consumers,” he said.

Ocean freight rates have increased by more than 200 per cent since the Red Sea crisis escalated in mid-December but this remains below the highs recorded during the Covid-19 pandemic, Emily Stausboll, data analyst at freight platform Xeneta, told The National.

Shipping rates for East Asia to the Mediterranean jumped to $5,871 per 40-foot container (FEU) on January 25, from $1,873 per FEU on December 14, according to Xeneta.

Rates for the Far East to North Europe also increased to $4,760 on January 25, up from $1,525 per FEU on December 14.

The rise in shipping costs may take some time to filter through to consumers and translate into higher selling prices, analysts said.

While companies may initially absorb the higher costs, they will eventually have to charge consumers a higher price if the Red Sea shipping disruptions continue for more than a few months, Jordan Poulter, senior consumer analyst at Fitch unit BMI, said in a webinar on Monday.

Companies who opt for more expensive alternatives such as air transport and who have thin profit margins, are more likely to pass that additional cost on to consumers, experts said.

Other analysts expect consumers will face delays in getting their hands on products, rather than paying more for them.

“The impact of the Red Sea crisis is likely to be felt by consumers in terms of delays in receiving goods rather than the cost of the goods themselves,” Ms Stausboll said.

“This is expected to be a relatively time-limited crisis and rates are still nowhere near the levels seen during the pandemic.”

Close watch

Car companies say they are monitoring the situation closely and are planning alternative routes as Red Sea disruptions continue.

They expect a “slight delay” in freight delivery as ships are rerouted through the southern tip of Africa.

“Volkswagen is in close co-ordination with the shipping companies and is monitoring the situation closely to assess the impact on production and market supply and, as far as possible, avoid it,” a Volkswagen representative told The National.

“Almost all the major shipping companies began rerouting their ships in December already. This will ensure that freight reaches its destination, albeit with a slight delay.”

General Motors, known for vehicle brands such as Chevrolet, “has implemented proactive measures to plan alternative logistics routings and shipping schedules to the region, to mitigate these disruptions”, a company representative said.

“These mitigation plans are serving us well and we don't anticipate any major disruption to our operations at the time being.”

Mercedes-Benz is also in “close contact” with its logistics providers and suppliers and is “continuously” monitoring the situation, said company spokeswoman Hannah Wolber.

“Our plants started production as planned after the winter break. Production is running almost without restrictions,” she said.

Steel manufacturers in the UAE are also being affected amid a rise in shipment costs. They said shipping costs have gone up by 15 per cent on break bulk and 30 per cent to 45 per cent in container shipments.

“This surge in transportation expenses directly translates to an increase in the cost of goods, posing challenges for companies to maintain competitive pricing,” Bharat Bhatia, chief executive and founder of Conares, the second-largest private steel producer in the UAE, said.

“As we navigate these challenges, there's a heightened emphasis on strategic cost management and innovative solutions to mitigate the impact on our overall cost structures.”

“There is a considerable impact on the export side” as shipping costs have gone up and sailing time has increased, he added.

The vessel sailing time has increased by seven to 14 days, depending on the discharge ports as the crisis continues, Mr Bhatia said.

The Red Sea crisis poses “a new threat to global supply chains and logistics”, said Saeed Al Remeithi, group chief executive of Emirates Steel Arkan, the UAE's largest public steel and building materials business.

The company has adopted a “comprehensive business plan” with a focus on “on sustaining operations, supplying high-quality products globally, and adapting to market dynamics”, he said.

“The company maintains constant communication with all its customers and suppliers, ensuring the timely delivery of orders. Additionally, irrespective of these particular circumstances, the company has a logistics team responsible for devising mechanisms for both domestic and international shipments,” he added.

Formed after the merger of Emirates Steel and Arkan Building Materials in 2021, the Abu Dhabi-listed company supplies products to the manufacturing and construction sectors in the UAE and to more than 70 markets globally, with Europe and the US as its biggest export markets.

Dubai-based luxury retailer Chalhoub Group, whose shipments of mainly cosmetics and perfumery mostly originating from Europe and the US are transported by sea freight through the Red Sea, has faced some delays but is mitigating the impact.

“As of now, our supply chain has not experienced significant disruptions, such as production delays from our suppliers,” Andreu Marco, group chief operating officer, told The National.

“Nonetheless, we are actively addressing this aspect through ongoing discussions with our suppliers, exploring the potential ramifications of any delays in the availability of goods for supply to the markets we serve.”

Meanwhile, budget furniture manufacturer Ikea said it did not expect supply shortages or changes in its pricing.

“The situation in the Red Sea will result in delays and longer lead times. We are in close dialogue with our shipping partners to ensure the safety of the people working in the Ikea value chain,” a company representative told The National.

“Even if transportation costs increase in the short term, it is only one of several factors affecting the price of our products. We remain committed to our work to strengthen the affordability of Ikea products.”

Alternatives by air and rail

Retailers and manufacturers are increasingly seeking to fly their goods to mitigate shipping delays and higher ocean freight costs.

Turkish Airlines is experiencing an increase in inquiries for its air cargo services, mainly originating from Pakistan, Bangladesh and the Far East, due to the Red Sea crisis, an airline representative told The National.

Most of the inquiries are for the transport of goods such as garments, electronics, automotive parts and industrial equipment to Europe and US destinations.

The inquiries take about two to three weeks to turn into transactions, according to the airline.

“The market outlook for air freight is optimistic and we are expecting and anticipating a higher shift from sea freight after the middle of February in case the conflict continues longer than a couple of weeks,” it said.

Xeneta data shows shippers are adopting a hybrid sea-air transport option, with a key corridor via Dubai where goods arrive via ocean from the Far East before being flown to their final destination in Europe, Ms Stausboll said.

Rail transport is also being explored as an option to transport goods to central Europe, according to Mr Menck.

While it is cheaper than air freight, costs are still higher than ocean freight and is by no means a shortcut – typical transit is still about 28 days, he said.

The shipping route around South Africa also comes with risks, such as piracy, and weather conditions that are not suitable for all vessel types, Mr Menck said.

“There is no 'one size fits all' approach, and companies are finding innovative solutions,” he said.